Report : Ted Baxter

Content : Commonwealth Bank statements, Automatic social behaviour, mythbusters, Bernie Ripoll, AEC Carey Ramm, ASIC Tony D’Aloisio

Friday, 23rd December 2011

The CBA is in for a Stormy time as The Plain Truth engages mythbuster techniques to bring down the banks house of cards.

In late 2009 when the editor of The Plain Truth approached me with this crazy idea of setting up a news site that actually researched its topics before being published and limited is investigations to one topic at a time, I thought it sounded great so I volunteered. I didn’t realise the intensity, stress and extent of the work required to research a story as an amateur investigative journalist who had not previously had a word published.

Fortunately for me the devastated people I have interviewed and the information I have gathered, have led me to believe that The Plain Truth and in a small way myself can make a difference. This was enough to keep me going. More recently the material I have been reviewing has sparked an intense interest within me and the anger I feel as I wade through the ocean of lies has ignited a passionate quest for justice.

My task now relates to the general perception and the many myths that exist about Storm & Storm clients. My sole professional qualifications are in the area of economics whereas these Myth Busting tasks require among other things a degree in psychology and human behaviour, which I don’t have. I can’t promise you perfect answers but I can promise you at least good answers based on underlying facts and that I will do my best for you.

Myth busting required me to consult a number of experts, particularly in the areas of psychology, law, accounting, finance and financial planning. Some of the myths I will be investigating include:-

– The Storm client base was mainly the elderly and vulnerable

– Storm clients were greedy and deserved what they got

– Storm gagged itself in Dec 08 – why would it?

– Storm charged exorbitant fees

– Storm advice was a one-shoe-fits-all approach

– Storm double geared its clients

– Storm highly leveraged its clients

– Storm couldn’t have ridden out the huge market falls anyway

– Storm put on lavish holidays for its clients & advisors

– Storm wasted money on lavish offices

– Storm dosed clients with oxygen and used listening devices

– Storm had client losses totalling $3B

The scale of the CBA / Storm disaster was immense, very personal and severe to each of the injured parties. The disaster occurred in the financial sector of our economy which is highly structured and multifaceted with each facet being extremely complex. This complexity was manipulated by the banks and more so by CBA than the other banks in order to throw a smokescreen around what started out as a CBA mistake (albeit a large one). As the enormous consequences of the banks errors emerged the bank decided to protect its bottom line by implementing an elaborate cover up to deflect blame rather than face the music.

Before I commence Confirming or Busting the myths I need to try to explain to you in simple terms what underlying methodology the CBA and their main allies employed to create these perception altering myths. In order to create and commence a perception that the majority of people and the media would believe the CBA needed the assistance of co-conspirators, some of whom included:

– Mr Ivan Middleton and others from the FPA to add apparent legitimacy to CBA’s outrageous claims

– Mr Bernie Ripoll to add the weight of Parliament and control and filter the questions away from the CBA

– Mr Tony D’Aloisio from ASIC who it appears may have initially been an unwitting participant but who ultimately bent to the will of his political master Bernie Ripoll and knowingly perverted the course of justice

– Mr Carey Ramm from AEC group and his mates Tony Raggat from the Townsville Bulletin and Isi Dalle Cort. Ramm had a personal axe to grind against Storm dating as far back as 2001 and was instrumental in inserting Damian Scattini into the SICAG meetings and was a close associate if not personal friend of Bernie Ripoll.

Automatic Social Behaviour

Banks in general and the CBA in particular wield extraordinary power and influence and have centuries of experience in the art of manipulation through the use of propaganda, misinformation to discredit others and the enviable position of being the bastions of capitalist society rendering them immune to criticism and impervious to attack. The CBAs ability to withstand credible attacks regardless of how legitimate a grievance may be against them is fiendish and cunning (worthy of Private Baldrick).

Banks in general and the CBA in particular wield extraordinary power and influence and have centuries of experience in the art of manipulation through the use of propaganda, misinformation to discredit others and the enviable position of being the bastions of capitalist society rendering them immune to criticism and impervious to attack. The CBAs ability to withstand credible attacks regardless of how legitimate a grievance may be against them is fiendish and cunning (worthy of Private Baldrick).

Now here comes the hard part – the explanation of how the CBA managed to fool so many. They took advantage of a phenomenon known as Automatic Social Behaviour. You may be more familiar with the term ‘The Power of Suggestion’. ‘We [humans] have an innate tendency to imitate. We whisper to someone who is whispering, we start to speak much louder when others do so. We scratch our head upon seeing someone else scratch their head. We walk slower in the presence of the elderly, we cycle faster after we have seen a cycling race on TV, and, yes indeed, we get a fine for driving too fast after we have been watching a Formula One Grand Prix. This tendency to imitate is the consequence of the way we — or, rather, our brains — are shaped. Social perception has a direct effect on social behaviour. Perceptual inputs are translated automatically into corresponding behavioural outputs. As a result, we often do what we see others doing’. Accordingly we often react as others want us to react, in this case the ‘others’ being the CBA and ASIC, both of which are strong, well resourced, cunning, formidable forces to come up against and powers unto themselves. On the surface there is nothing wrong with being a large powerful organisation until such organisations fall into unscrupulous or inept hands.

In the case of Storm and its clients, the CBA acted for its own self interest with reckless disregard to the consequences of its own behaviour, whilst at the same time the puppeteers pulling the strings within the CBA were ruthless in their quest for scapegoats. Just look at the CBA’s actions towards its own staff. Support staff lower in CBA’s food chain had been made an example of in order to cover the backs of those higher up the CBA chain. People like Graham Lynham, Andrew Jackson, Kamal Arnaout and John Hoey were unjustifiably dismissed. Others such as Edward Jewell Tait were ‘retired’ out of their positions for ‘personal reasons’ after receiving ‘undisclosed sums of money’. Clearly the likes of Mr Tait are protected because they know where the bodies are buried. Tait has since popped up as Managing Director and Head of Private Banking at Credit Suisse in Sydney…in case you feel inclined to have a chat with him.

Both the CBA and ASIC protagonists were unified in their treachery. When it came to attacking Storm clients the CBA’s right hand always knew what the left hand was doing, they were well co-ordinated, strongly focused and answered to no-one but themselves. ASIC on the other hand had to answer to its political master as well as being subservient to the powerful within the banking sector in the aftermath of the GFC. ASIC has and will continue to take the path of least resistance. An example of this is ASIC’s action to bury the already existing deceptive and misleading conduct action in the federal court against the CBA. At the same time ASIC tried to make a hero of itself by attacking the selected little guys such as former Storm advisor Stuart Drummond who on our reckoning was an remains a stand up guy and with the evidence pointing to him having done nothing wrong, but more about the Drummond evidence and the truth about how ASIC shot itself in the foot in a later story. ASIC’s action display the characteristics of a bully – bash up the little kids in the school yard and suck up to the bigger ones all the while pretending that their private parts are as big as what Mr Norris makes out. Unfortunately for ASIC as an organisation the unscrupulous and inept within it although fewer in number, are greater in influence (80/20 rule). Even more unfortunate for the former Storm clients, ASIC chose to protect the CBA which meant CBAs victims had to remain out in the cold. This means actions such as those perpetrated by the CBA will forever continue to go unpunished unless people like you take control of your own lives, shed the shackles of fear and act.

Drunk with the arrogance of past victories and emboldened with the power to do so, the CBA simply created each untruth, wrapped it up in a lie and presented the deceptions creating stories that cleansed it of its wrongdoings. Once CBA’s myths were ignited they required 2 things to keep them going and make them a raging inferno of official support for the banks own position. The first requirement the bank needed was to light fires with its lies all over the place. The CBA achieved this by sending false and misleading letters to Storm clients, spending millions on spin doctors, using its influence with the press through its advertising budgets, being the first to play the ‘whistleblower / snitch’ card with ASIC and feeding the Parliamentary inquiry sufficient lies and half-truths to enable Mr Ripoll to ‘justifiably’ draw the conclusions required and demanded by the CBA.

I am well aware of the gravity and seriousness of the allegations implicit and explicit in what I write. I also understand that these allegations are so far reaching and difficult to believe that I am exposing myself and The Plain Truth to the possibility of being seen as just another ‘conspiracy theorist’ or ‘crazy’ on the net. As this long hot summer progresses I do intend to provide you with the evidence as I have been doing to date but for now and until all the evidence unfolds, I will quote to you from Shakespeare, “There are more things in heaven and Earth, Horatio than are dreamt of in your philosophy”. Put more simply the truth is often stranger than fiction.

This brings us to the second requirement – the CBAs need to sustain its story. Whilst the deception approach in most cases is successful for the bank it does have a serious Achilles heel. It is necessary for the bank to ensure that the truth and their deceptions never meet. Just as enough water extinguishes fire so does the truth extinguish deception. For 3 years it seems the truth has been suppressed, but no more.

Here is a challenge for you:-

1) Write down your perception in a few words about what you think went wrong

2) Write down your perception about who you think is responsible

3) How early did you form these perceptions and have they changed in time. If so, determine in your own mind why you think these perceptions have changed

Now the important part…

4) Write down the FACTS (not hearsay) which you believe led you to these perceptions

5) Write down the sources of the evidence or facts

Where do you fit?

a) If your evidence is here-say then your perception and opinion is unworthy and you have succumb to Automatic Social Behaviour (The Power of Suggestion)

b) If your evidence is documented but incomplete then your perception and opinion is likely to be unworthy and you have probably succumb to Automatic Social Behaviour. In order to make your opinion worthy make a point of getting the ALL of the facts to complete the story. You will have seen in previous articles on The Plain Truth website the damaging power of half-truths.

c) If you are satisfied that your documented evidence is complete then your perception and opinion is likely to be worthy and objective and it is unlikely that you have been suckered by the Power of Suggestion.

In the event that you actually have documented evidence we beg you to send a copy in to The Plain Truth, maybe for your benefit, but more importantly for the benefit of many other CBA victims. Be part of the truth and make a point of fully understanding your own story.

The Plain Truth is urgently in need of volunteer copywriters, proof-readers and investigators. Copy material and lines of investigation will be provided by The Plain Truth. Anyone who is able to assist in any of these areas please contact:

The Editor

The Plain Truth,

PO Box 2783

New Farm QLD 4005

Content : Commonwealth Bank statements, Automatic social behaviour, mythbusters, Bernie Ripoll, AEC Carey Ramm, ASIC Tony D’Aloisio

This will be the final report concerning the letter sent by the Commission against Bank Atrocities (CBA) to the Board of Directors of the Commonwealth Bank of Australia (CBA). We have all heard the diametrically opposing expressions “the buck stops here” and “pass the buck”. The Commission has attempted to ensure that the buck stops somewhere and that should be at the point of ultimate accountability. Unfortunately The Plain Truth has found that the ‘buck’ is a very slippery little vegemite and doesn’t seem to stop in the right spot. Broadly the trail and rationale behind the commission’s letter is quite simple.

This will be the final report concerning the letter sent by the Commission against Bank Atrocities (CBA) to the Board of Directors of the Commonwealth Bank of Australia (CBA). We have all heard the diametrically opposing expressions “the buck stops here” and “pass the buck”. The Commission has attempted to ensure that the buck stops somewhere and that should be at the point of ultimate accountability. Unfortunately The Plain Truth has found that the ‘buck’ is a very slippery little vegemite and doesn’t seem to stop in the right spot. Broadly the trail and rationale behind the commission’s letter is quite simple.

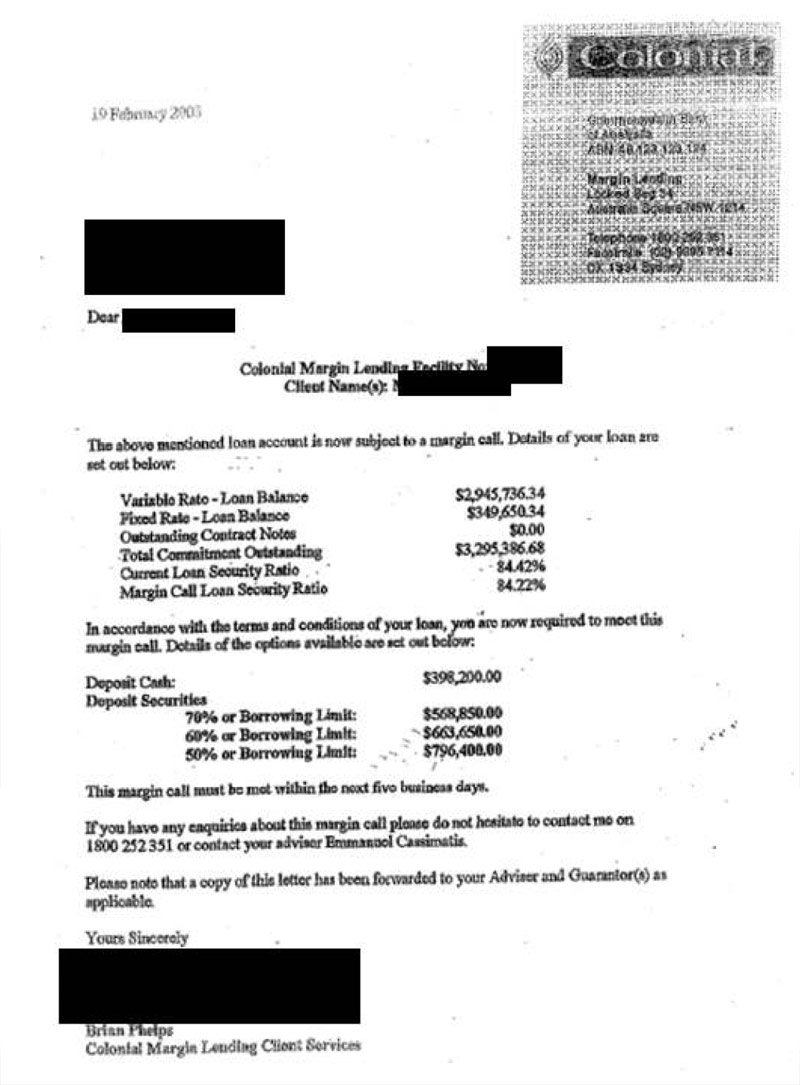

As I continue investigating the matters relating to CBA and Storm I never ceased to be amazed at how talented and slick the CBA was at deception and misdirection. I also fully appreciate that my amazement can only stem from my own naivety. After all an organisation, especially a bank of this size, with the resources available at its disposal can and does act with impunity and disregard to any human cost. The following sequence of events reflects another successful play by the CBA in its continuing campaign to take down Storm Financial and its clients. The CBA used all means at its disposal including unleashing another of its ‘dogs of war – Colonial First State (CFS)’, a direct subsidiary of CBA.

As I continue investigating the matters relating to CBA and Storm I never ceased to be amazed at how talented and slick the CBA was at deception and misdirection. I also fully appreciate that my amazement can only stem from my own naivety. After all an organisation, especially a bank of this size, with the resources available at its disposal can and does act with impunity and disregard to any human cost. The following sequence of events reflects another successful play by the CBA in its continuing campaign to take down Storm Financial and its clients. The CBA used all means at its disposal including unleashing another of its ‘dogs of war – Colonial First State (CFS)’, a direct subsidiary of CBA.