Editor : Perry White

Content : Parliamentary Joint Committee, Storm Financial, Bernie Ripoll

Friday 11th May 2012

When this website was established, the angry men and women behind it were determined to get something done. How this was to be done was encapsulated in The Plain Truths mission statement – to shed the light of truth onto the darkness of deceit for the purpose of obtaining justice.

The objective is to be satisfied that the main issues are exposed, a complete picture of any truth emerges and a level of corrective action (justice) has been initiated. Unless justice is precipitated by action merely exposing the truth is a waste of time. Accordingly The Plain Truth will not only be reporting the truth but also actively encourage passive and legal action by people affected and anybody interested in doing the right thing.

The objective is to be satisfied that the main issues are exposed, a complete picture of any truth emerges and a level of corrective action (justice) has been initiated. Unless justice is precipitated by action merely exposing the truth is a waste of time. Accordingly The Plain Truth will not only be reporting the truth but also actively encourage passive and legal action by people affected and anybody interested in doing the right thing.

The Plain Truth will now report on the progress of our mission whilst taking the opportunity to cover a few other matters.

The Commission

The original seven members of the Commission against Bank Atrocities have resolved and ratified through a majority vote of all commission members that the name of the Commission be changed to the Commission on Banking and Financial Services. The new name reflects a broader investigative scope which is not simply limited to banks but includes other financial institutions such as Fund Managers and Securities Dealers.

Parliamentary Joint Committee Inquiry

On Wednesday 29th February 2012 some members from the Commission met with representatives of The Plain Truth. At that meeting it was established that the combined information held between the parties was more than sufficient to warrant a fresh inquiry into the role the Commonwealth Bank played in collapsing so many Storm client portfolios. The Commission understands that various groups and individuals are at the early stages of independently communicating with politicians for the purpose of having a new inquiry established. To date the four members of parliament who have been approached have all given qualified support with one exception. Two out of the four were quite enthusiastic, one (1) reserved but more positive than negative whilst the fourth member was completely negative and stated “that it (the re-opening of the inquiry) wouldn’t happen”. Naturally the fourth member in question was none other than Bernie Ripoll (mobile phone number 0418 763 351) who has a vested interest in resisting the truth because of his involvement in the cover-up and his inept chairing of the original inquiry. The inquiries conclusions speak for themselves with no sanctions against the CBA or the banks in general and the granting of licence for the banks to continue acting with impunity.

The Commission has evidence showing that Bernie Ripoll was obstructing the exposure of the truth in many ways including:

– By refusing to include the CBA or any bank in the initial terms of reference of the Inquiry into Financial Products and Services in Australia,

– By refusing to include the CBA or any banks in the terms of reference in any of the hearings,

– By abusing the Chairman of SICAG,

– By directing that Emmanuel Cassimatis NOT make a written submission to the inquiry,

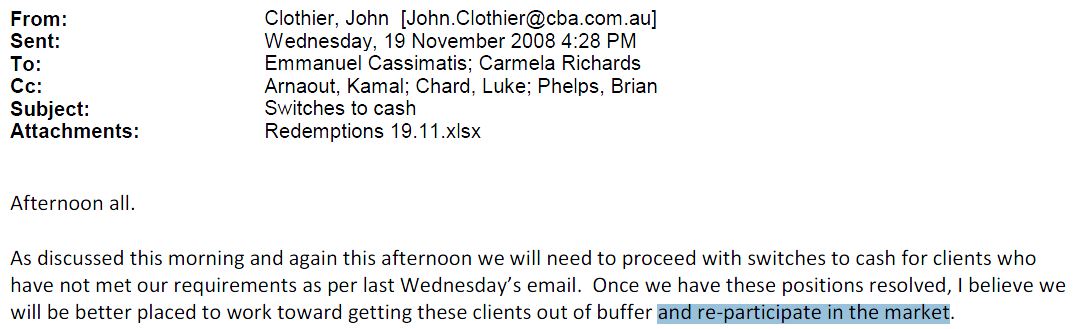

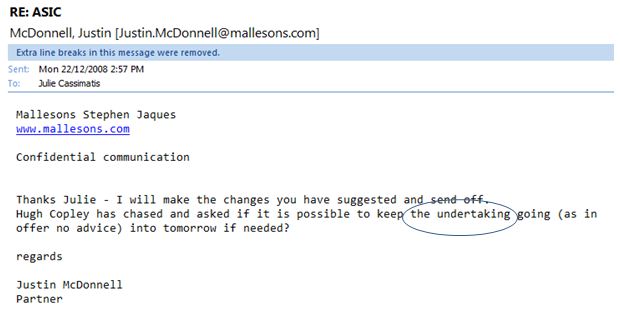

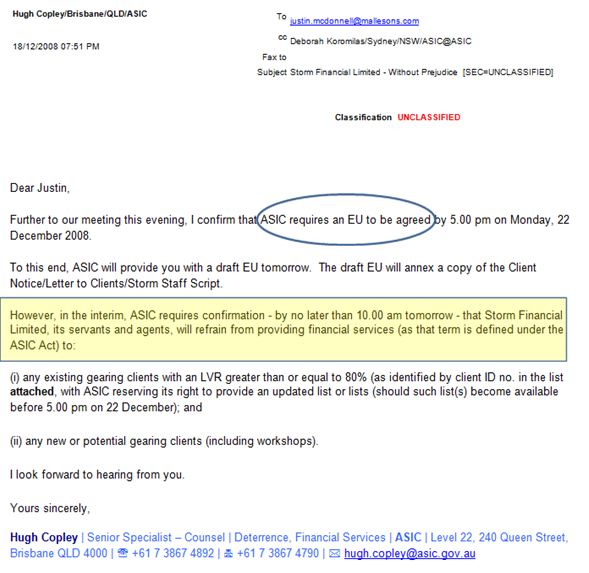

– His refusal to accept documents presented to him at the hearings which proved that CBA lied. Copies of these documents some of which were supplied by former Storm clients and some sent in anonymously to The Plain Truth by persons within both the CBA and ASIC are in the possession of the Commission.

Accordingly after 17 weeks of The Plain Truth publishing some of the evidence gathered, the next phase of endeavours is about to commence. The task which now confronts the Commission, The Plain Truth and CBA’s victims is to act to re-establish a new PJC Inquiry.

To this end the following actions will occur:

– The Commission and The Plain Truth will consolidate all the evidence,

– The Commission will take over where possible and spearhead the approach to ALL members of Australia’s parliament,

– The Commission will draft proposed terms of reference for the re-opening of the Inquiry,

– The Plain Truth will report on the Commissions progress and publish the proposed terms of reference on The Plain Truth website and open the terms of reference for discussion and input by the Australian public and in particular CBA’s victims.

– The Commission will prepare a document of argument and evidence to be presented to all members of parliament.

Storm Financial – Past Activities

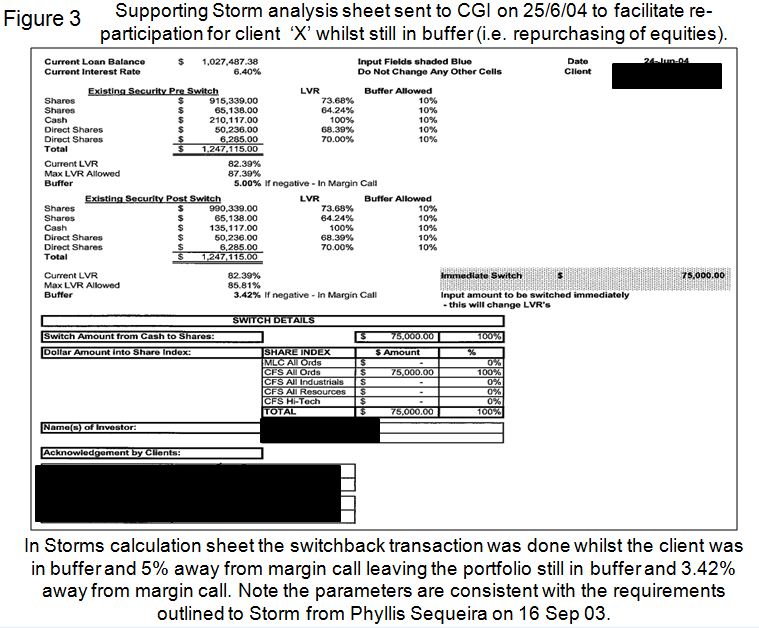

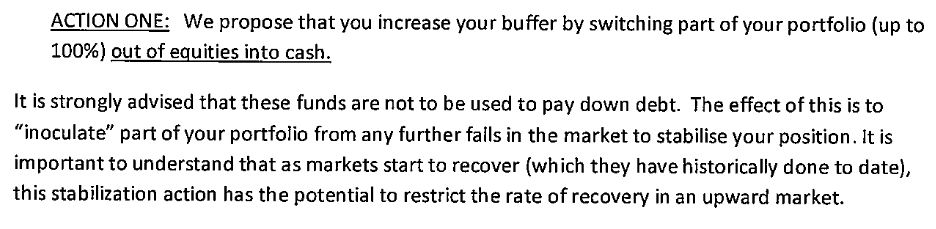

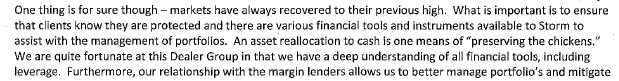

The Plain Truth has received some emails asking why there seems to be a lack of sufficient scrutiny of Storm Financials activities leading up to Jan 2009. The answers to these questions are simple. The Plain Truth investigators have been given the task of determining what the state of affairs was based solely on evidence, first hand statements and facts. Our investigators have diligently followed the direction in which the facts point. There have been a lot of allegations levelled at Storm and its advisors and to date The Plain Truth has not been provided with any facts to back these allegations. On the contrary where The Plain Truth has been provided with negative opinion about Storm, any facts The Plain Truth has been able to uncover have pointed in the opposite direction to the negative opinion. The Plain Truth and the Commission strongly requests any evidence which points to wrong-doing by Storm Financial, its directors, staff and advisors be sent to The Plain Truth. This may be sent via the ‘contact us’ tab on our website or via email to ‘[email protected]’ or to our postal address The Plain Truth, PO Box 2783, New Farm QLD 4005.

Actions required by YOU going forward…

As we have already pointed out to a number of people, the truth alone will not result in justice and the appropriate level of compensation for the wrong you have been caused. On the other hand action alone unsupported by truth is just as futile. Both the TRUTH and ACTION is required to achieve a just outcome. It is time for the party to begin in earnest and those who have the energy and the integrity must act. It was very clearly people power that initiated the original Inquiry. Unfortunately at that time the facts were still unavailable allowing people such as Carey Ramm, Bernie Ripoll, Ralph Norris, Ian Narev and many other vested interests to hijack the Inquiry and play the highly charged emotions of a destroyed and distraught group of people like a fine violin.

Now in a much cooler environment and armed with the facts a rejuvenated inquiry, which is the very thing the CBA fears most, would blow the shams of the last 3 years wide open. The facts are gathered, the time is ripe, the enemy is complacent making it the time to strike. The three important steps now required are:

1) For YOU to get the truth out to as many people as possible

2) For YOU to lobby the politicians once armed with the truth (print the evidence from the website)

3) For YOU together with others and armed with the truth to conduct meetings from Cairns to Melbourne

We of the Commission are victims along with everyone, have lost our wealth are angry, frustrated and exhausted. We understand very well and clearly the ease with which it is possible to sit, do nothing and let others carry the load. At the same time we also understand that many have hitched their wagon to various actions and class actions in the hope of getting a just and fair settlement. Like it or not the Commissions believes that this can NEVER happen. Accordingly if there is not sufficient action by YOU then regardless of the amount of truth available, outcomes will remain unsatisfactory. You know what is required…A LAWFUL UPRISING! Do not expect instant results but take heart by looking at the number of facts that have been uncovered in just 17 weeks. Also take heart from the knowledge that outcomes will be satisfactorily achieved is sufficient action is taken.

The Editor

The Plain Truth,

PO Box 2783

New Farm QLD 4005

Content : Parliamentary Joint Committee, Storm Financial, Bernie Ripoll

Damian Scattini’s response was to deftly avoid answering the question by diversion. He pointed out spelling errors and the fact that The Plain Truth provided no telephone number among other irrelevancies. The Plain Truth has noted that in many of Mr Scattini’s appearances he uses derision and demonising tactics to whip his selected group into a frenzy to support his quest for business. On a more positive note this guy is very skilled at what he does, slick and smooth, dresses the part and dare we say even looks good doing it (just ask him).

Damian Scattini’s response was to deftly avoid answering the question by diversion. He pointed out spelling errors and the fact that The Plain Truth provided no telephone number among other irrelevancies. The Plain Truth has noted that in many of Mr Scattini’s appearances he uses derision and demonising tactics to whip his selected group into a frenzy to support his quest for business. On a more positive note this guy is very skilled at what he does, slick and smooth, dresses the part and dare we say even looks good doing it (just ask him).