Reporter : Ted Baxter

Content : ASIC & CBA compensation, Storm Financial settlement, ASIC gagging, Emmanuel Cassimatis, ASIC Hugh Copley

Wednesday 25th September 2012

The Plain Truths insider at ASIC, known as ‘Matador’, has provided quite valuable information to us over the last 12 months. In recent communications Matador cited in internal high level memo which outlined the tactics ASIC expected to use in its cases against the banks and Cassimatis’.

Matador was unable to obtain copy and only had a brief time to read part of the lengthy memo however was able to pass on some pertinent points.

The main thrust of what Matador read appeared to be an instruction to the ASIC legal team to “stay away” from Emmanuel Cassimatis as a witness and under no circumstances were either Emmanuel or Julie Cassimatis to be subpoenaed for ASIC’s case against the banks .

The reason given for this ASIC directive was to prevent Cassimatis from offering evidence which contradicted what ASIC called its ‘relationship based evidence’ in the case against the banks. Furthermore whilst ASIC funded Storms liquidators (Worrells) to the tune of half a million dollars to build a case against Storm and the Cassimatis’, a further directive was made by the highest levels within ASIC to under no circumstances offer any further funding to Worrells which may enable them to fulfil their duty as liquidators of Storm Financial by representing the best interests of Storm in court. This directive to withhold funding along with the ‘behind closed doors’ encouragement by ASIC to not have Storm represented in court has had the desired outcome for ASIC where…

STORM AS A DEFENDANT IN THE CASE LAUNCHED BY ASIC HAS NO LEGAL REPRESENTATION WHATSOEVER.

What democratic society would allow a defendant to be tried, whether guilty or not, without any representation whilst being completely denied any right of reply or response whatsoever?

This tactic is consistent and identical to the tactic used by ASIC from the beginning. That is, ASIC is [mis]using its power to protect the CBA and cover it own wrongful activities by using all means at its disposal to prevent any communication from emerging from the Storm camp thus ensuring that only the ASIC case is heard.

One should never condone wrongdoing but it happens. When it does we call the police. But to have the police help the burglar carry your stuff out to his car is a wrong too far…

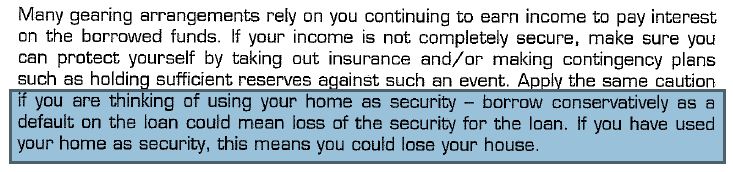

In 2008, following discussions with the Commonwealth Bank, AISC launched an investigation into Storm and extracted an undertaking from directors Emmanuel and Julie Cassimatis (click here for related article) which had the effect of gagging any communication with Storm clients. This prevented Storm clients from being able to obtain advice from Storm advisors at the time they needed it most. In other words ‘ASIC exceeded its authority’ because it did not regulate or police margin loans and thus stuffed up big time.

From that point on ASIC was forced to either come clean or cover its tracks. ASIC chose to cover its tracks and the method ASIC has consistently used has been to ‘gag all things Storm’. By ASIC frenetically attempting to cover their tracks, using the tactics they have been employing to date, ASIC have exposed to the general public that they do in fact have something to hide . One of many examples of the attempt to suppress information has been AISCs keystone cops approach to ‘due process’ or rather, the lack of attention to it as previously mentioned (i.e. no defendant representation or information from defendants). This approach by ASIC is ultimately doomed and will only waste time and money due to the inevitable appeals that will occur from chasing the wrong people.

The Plain Truth has proof that many Storm people, including Cassimatis, have attempted to meet with ASIC to provide the necessary evidence but have been denied even the right to talk to someone in ASIC face to face. The further the saga continues, the deeper they dig their own hole and the closer they expose themselves to a negative verdict by the court of public opinion.

The Editor

The Plain Truth,

PO Box 2783

New Farm QLD 4005

Content : ASIC & CBA compensation, Storm Financial settlement, ASIC gagging, Emmanuel Cassimatis, ASIC Hugh Copley