Reporter : Ted Baxter

Content : Hugh Copley ASIC, Ritesh Patel ASIC, Storm compensation, Storm emails, ASIC compensation.

Tuesday 26th June 2012

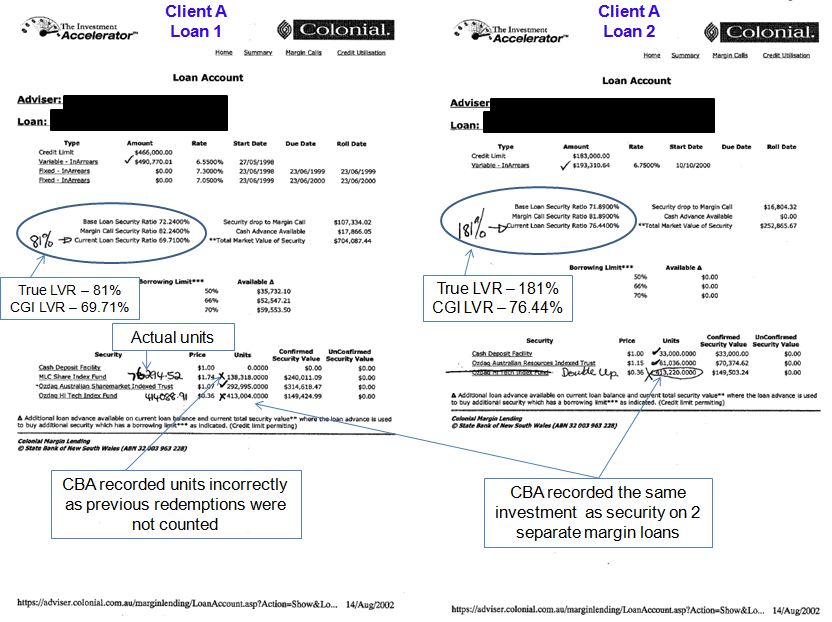

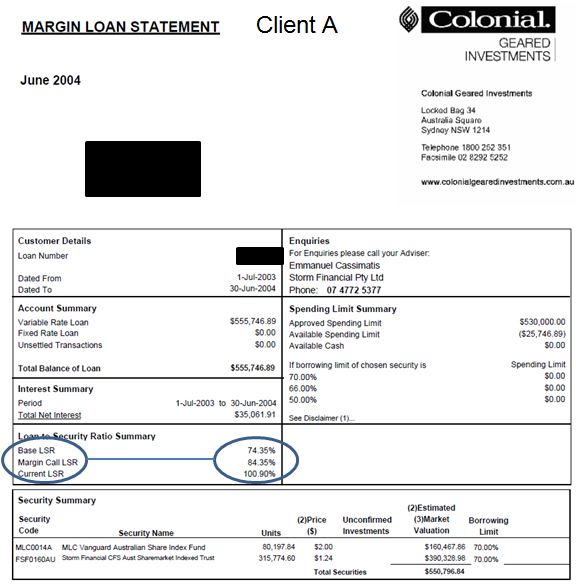

In late 2008 the CBA was alerted by Storm Financial Ltd that the CBA’s data to Storm clients was out of date and grossly inaccurate. This meant that Storm advisors and their clients were unknowingly transacting ‘blindly’ because of this wrong data. In fact there was insufficient information to protect investment portfolios in a rapidly declining equities market triggered by the GFC. At the same time banks around the world, including Australian banks, had massive concerns about solvency. These dual issues which confronted the CBA set the scene for the wanton and deliberate massacre of Storm and its clients by the CBA in order to protect itself.

From this point on, for whatever reason, ASIC acted in such a way that the inevitable consequences of ASIC’s actions was the collapse of Storm and its clients. ASIC acted either with deliberation or out of ignorance without checking whether CBA’s story to them was fact or fiction. ASIC was drawn into the affair, made a wrong judgement and should now be held accountable for the consequences of its actions at that time and since. Whilst ASIC is attempting to deflect its own culpability by attacking the unregistered investment scheme ‘straw man’, reality and natural justice demands that ASIC compensate Storm clients for its own gross negligence.

The Plain Truth has documents, some of which have been provided by a source in ASIC, confirming that ASIC’s and Hugh Copley’s reactions against Storm were of the knee-jerk kind. Discussions held with various solicitors confirmed that ASIC’s usual approach, following extensive investigations resulting in similar Enforceable Undertaking situations, is fairly regimented with limited flexibility available to the accused when it comes to the Enforceable Undertaking. The documents held in The Plain Truths possession highlight:

The Plain Truth has documents, some of which have been provided by a source in ASIC, confirming that ASIC’s and Hugh Copley’s reactions against Storm were of the knee-jerk kind. Discussions held with various solicitors confirmed that ASIC’s usual approach, following extensive investigations resulting in similar Enforceable Undertaking situations, is fairly regimented with limited flexibility available to the accused when it comes to the Enforceable Undertaking. The documents held in The Plain Truths possession highlight:

– That almost NO proper investigation was conducted prior to ASIC’s attempt at forcing an undertaking.

– That the sole source of information that ASIC acted upon at the time was the CBA.

– That a reading of the EU document confirms that ASIC’s aim was to prevent Storm from communicating with it existing and potential clients consequently blocking Storm clients from being able to receive advice from Storm, leaving the CBA as the only source of accessible information (which was essentially…’pay up or else’).

– That ASIC was disinterested in the type of business structure that Storm had. This has been recently confirmed in a transcript of a phone call with Ritesh Patel of ASIC.

Ritesh confirmed during a telephone conversation in mid-April 2012 that when the GFC first happened, the usual process in litigation from ASIC is to close things down to stop people getting hurt further. While ASIC did this at the time, they didn’t realise that by preventing people from talking to their advisers they were actually hurting them more. Ritesh admitted that was a huge mistake.

– ASIC’s disinterest in the consequences to Storm clients of placing a gag on Storm…for any duration.

– ASIC flip-flopped by contradicting itself when demanding the EU from Storm.

ASIC claimed that a 12 month gag / EU would not materially impact Storm

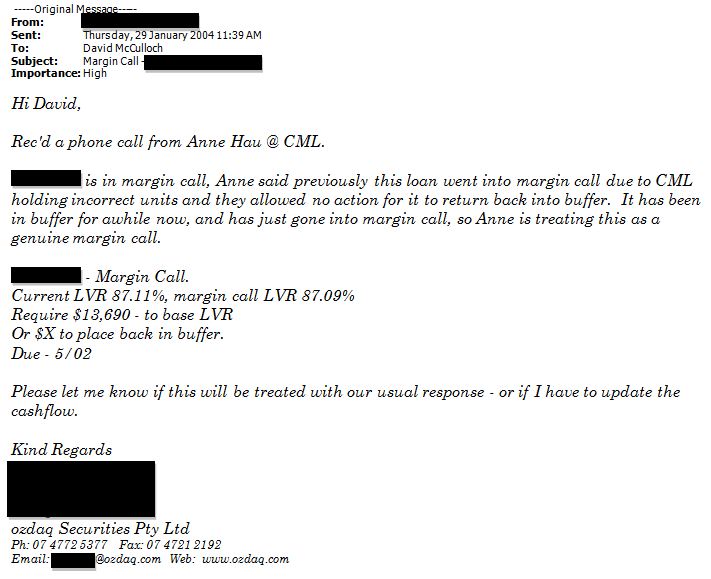

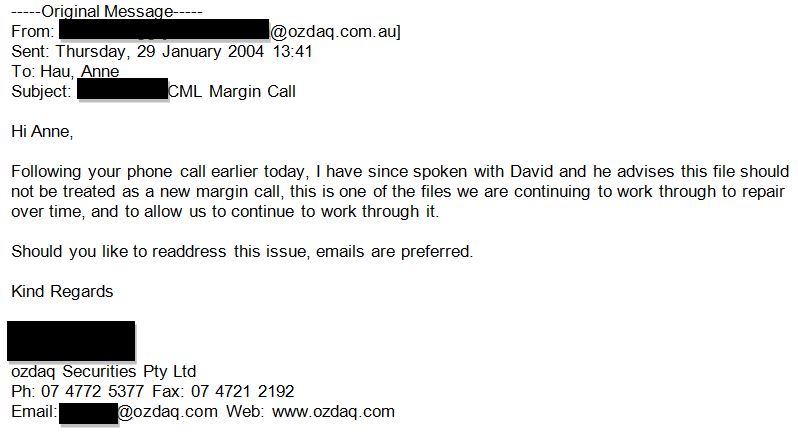

During the negotiations between ASIC and Storm whereby ASIC was demanding an Enforceable Undertaking be signed, ASIC’s disinterest of the effect of its actions became apparent. From the outset ASIC demanded a ‘gag’ for a period of 12 months. During this period Storm and its servants would not be allowed to engage, in any way, with any of its existing existing geared or any new or potential gearing clients (effectively ANY potential clients).

Storm advised ASIC through its solicitors on 22 Dec 08 @ 3:08pm that “Our clients [Storm] have considered the terms of the enforceable undertaking (“EU”). The difficulty with the proposal is that the current independent financial advice that they have received is that the EU, in those terms, will push the organisation into voluntary administration. That means 14,000 clients will be without access to advice and 126 jobs will be lost. That cannot be the object of ASIC’s regulatory role.”

Hugh Copley and ASIC’s flip-flop occurred when they claimed in a response email to Storms solicitor dated 22 Dec 08 @ 4:22pm that, “ASIC does not accept that the EU will have the impact upon your [Storms] client’s business that your email suggests. The impact of the EU will preclude your client from dealing with 3,000 of its 14,000 clients,…”.

Whilst alleging above that ASIC did not accept Storms dire analysis of ASIC’s demand on its business, ASIC subsequently nonsensically admitted in the same email dated 22 Dec 08 @ 4:22pm that, “…those [3,000] clients [are] responsible for the mainstay of your client’s income.”.

Finally, in the same email, ASIC acknowledged that the EU would impact Storm business and consequently Storm’s clients, “However, ASIC appreciates that the EU will have an impact upon your client’s income stream”.

That ASIC was alerted in 2008 to the consequences of their proposed EU was further confirmed in an email from Storm Financials solicitor to Storm dated 20 Dec 08 @ 4:20pm where the solicitor believed that ASIC would understand the impact of placing a gag on Storm would have on them, “ASIC would have to be conscious of the devastating financial effect of the EU on the business [Storms clients] and we may be able to persuade them of an alternative, although that will be difficult.”

The only motivation that The Plain Truth has been able to uncover for ASIC’s actions is the dialogue that ASIC had with the CBA in late 2008 as The Plain Truth exposed in its article “Was Storm Gagged, A Reality, not a myth”.

Clearly ASIC did not know what it was doing. Hugh Copley’s and ASIC’s sole focus at that stage was to prevent Storm from engaging with its clients and “closing things down”. This again has been recently confirmed in a transcript of a phone call with Ritesh Patel from ASIC.

Ritesh confirmed during a telephone conversation in mid-April that when the GFC first happened, the usual process in litigation from ASIC is to close things down to stop people getting hurt further. While ASIC did this at the time, they didn’t realise that by preventing people from talking to their advisers they were actually hurting them more. Ritesh admitted that was a huge mistake.

The Plain Truth repeats… Whilst ASIC is attempting to deflect its own culpability by attacking the unregistered investment scheme ‘straw man’, reality and natural justice demands that ASIC compensate Storm clients for its own gross negligence. Such compensation will remain unlikely until victims demand straight and on topic answers from ASIC. To date ASIC has used weasel words to avoid direct answers.

ASIC contact details:

Greg Medcraft [email protected]

Hugh Copley 0434 565 199, 07 38674892 [email protected]

Ritesh Patel 07 3867 4718 [email protected]

The Editor

The Plain Truth,

PO Box 2783

New Farm QLD 4005

Content : Hugh Copley ASIC, Ritesh Patel ASIC, Storm compensation, Storm emails, ASIC compensation.