Reporter : Jimmy Olsen

Content : Storm Financial advice, CGI margin lending rules, Storm re-participation strategy, CBA & Storm.

Tuesday 22nd May 2012

Note from Editor – If you thought that getting to the truth would involve a little bit of light reading then The Plain Truth apologises for the hugely technical information we are about to dump upon you. Our choices are to go up the emotional pathway as most blogs, forums and journalists tend to favour because it gets a quick response OR to take long and correct route and obtain the truth by exposing the technical foundations that make it up. Again we apologise for the length of this article but believe it necessary. Enjoy…

Â

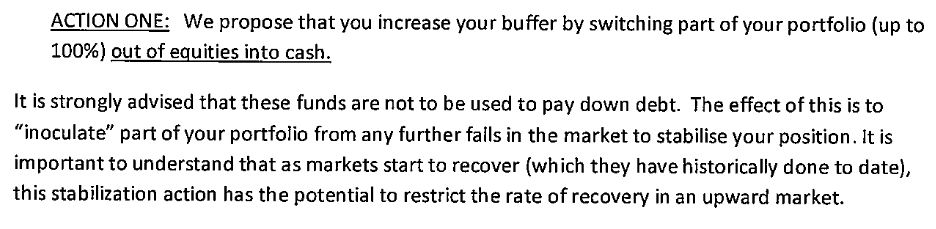

On 8 Oct 2008 Storm Financial wrote to all its clients seeking authority to re-balance their asset allocation by switching “UP TO 100%†of their portfolio from equities to cash. The amount to be switched would ultimately depend on each individual client personal positions with factors such as existing cash reserves, current LVR and buffer being considered individually.Â

Storm claimed the purpose for these switches was to reduce the effect on the individual portfolios of further market falls. This then leaves each portfolio in a position to be able to re-participate back into an improving equities market (whenever that should occur) by reallocating portfolio assets back from cash to equities. Storm further claimed that the margin lenders, in particular Commonwealth Bank, had acknowledged such a re-participation strategy, that this re-participation had been used successfully in the past and that the margin lenders (CGI) facilitated this by allowing switching to occur whilst portfolios were still in buffer.

In any event if such a Storm strategy existed it was prevented from being implemented by the joint actions of ASIC preventing Storm from communicating with its clients in Dec 08, CBA's data defects and denials of wrongdoing and the CBA wrongly forcing Storm into administration on the 8th Jan 09.

The Plain Truth has investigated Storms re-participation claims. We can now report the results of this investigation and give answers raised about Storms claims.

Q: Did Storm Propose a Switching and Re-participation Strategy in 2008?

Yes.

The following is an extract from the 8 Oct 08 Storm letter to clients which clearly identifies a proposed switch from equities to cash.

Q: Did Storm claim that it had the co-operation of the margin lenders for re-participation?

Yes.

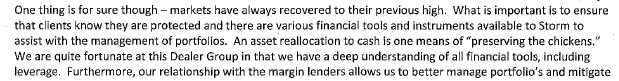

The Plain Truth has obtained an internal Storm email dated 28 July 08 provided by a former employee of Storm. This email was distributed by ex Storm advisor and senior executive Mr David McCulloch who was also a former senior banker with the CBA. Given his previous experience and banking knowledge Mr McCulloch was responsible within Storm for most of the high level negotiations between Storm, the banks and margin lenders. The following extract from his email to Storm advisors and staff clearly indicates that Storm had the co-operation of margin lenders to facilitate clients' re-entry back into the equities markets. Most importantly, this co-operation existed even whilst clients' margin loans were in buffer.

Q : Did Storm have formal permission from CGI to transact whilst in buffer for re-participation outside the normal terms and conditions?

Yes.

The following is an extractfrom a letter dated 16 Sep 03 and sent from the then General Manager of Colonial Margin Lending, Mrs Phyllis Sequeira, to Mr David McCulloch as part of his Storm duties. You will note that this relatively small extract confirms:

1)Â Â Â Â Â Storm clients were allowed to transact whilst in buffer,

2)Â Â Â Â Â That Storm had the co-operation of the banks,

3)Â Â Â Â Â Acknowledge that Storm has a re-participation (switching) strategy.

Q: Did in fact the CBA acknowledge re-participation?

Yes.

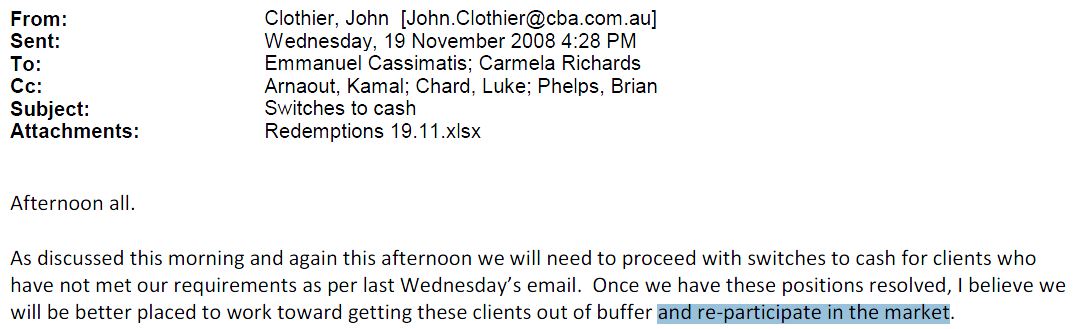

As can be seen in the following extract from an email authored by CGI’s John Clothier on 19 Nov 08 to Storm, it is quite clear that the CBA recognised the need for re-participation after CGI was able to resolve clients positions, with the cooperation of Storm.

It is interesting to note that the CBA was consistent in its recognition and cooperation with Storms re-participation strategy that was first implemented during the crash of 2001-2003.

THE BIG QUESTION

Q: Did Storm really have a successful re-participation strategy available as they claimed?Â

If so, how did it work?

…to be continued on Friday 25th May 2012.

(click here to view the Conclusion to ‘Storm Financials re-participation strategy: Did it exist?’)

Comments are closed.