Report : Tricia Takanawa / Jimmy Olsen

Content : ASIC gagging, ASIC Hugh Copley, Storm clients, CGI margin call, ASIC Tony D’Aloisio statements, SICAG article

Sunday, 8th January 2012

The Commonwealth Bank needed ASIC to gag Storm. In the week leading up to the 12th Dec 08 the CBA duped ASIC with an unreal allegation which ASIC accepted. Having predetermined that ASIC would support the CBA and condemn Storm, it was necessary that ASIC not investigate the validity of the allegation because the culpability would point to the CBA rather than Storm.

ASIC’s justification for the Gagging of Storm

There has been an enormous amount of comment and interest surrounding the gagging of Storm. There have been claims, counter-claims and strong denials by ASIC including very specific lies by Mr D’Aloisio to the Senate estimates committee. When I commenced investigating the gagging story my mind was limited to the events of Dec 08 when ASIC prevented Storm from communicating with their clients. It did not take long to discover that the cone of silence required by the CBA was so extensive that the gagging events of Dec 08 were only the tip of the iceberg. It quickly emerged very early in my investigations that the relevant topic of inquiry was about the gagging of the truth and information and not just about the gagging of Storm. The gagging of Storm was only a small part of CBA’s need to subvert the truth.

A successful campaign of deception has 2 requirements. The first is the story that makes up the deception itself. In this case the story that the CBA wished to put out, needed a particular spin on events of late 2008. The second requirement is that the actual truth be suppressed otherwise it will get in the way of deception and spin. As most of us already know nothing interferes with a good yarn like the truth.

It’s now time to begin with the facts…

The Plain Truth has already written in past articles about the various CBA data errors that occurred throughout 2008. These data errors led to the cataclysmic failure of the CBA to issue margin call notices at a critical time when equity markets were rapidly in decline. The bank’s failure to issue margin call notices resulted in the bank commencing a campaign of disinformation by issuing false and misleading letters to Storm clients on the 8th, 9th and 17th Dec 2008.

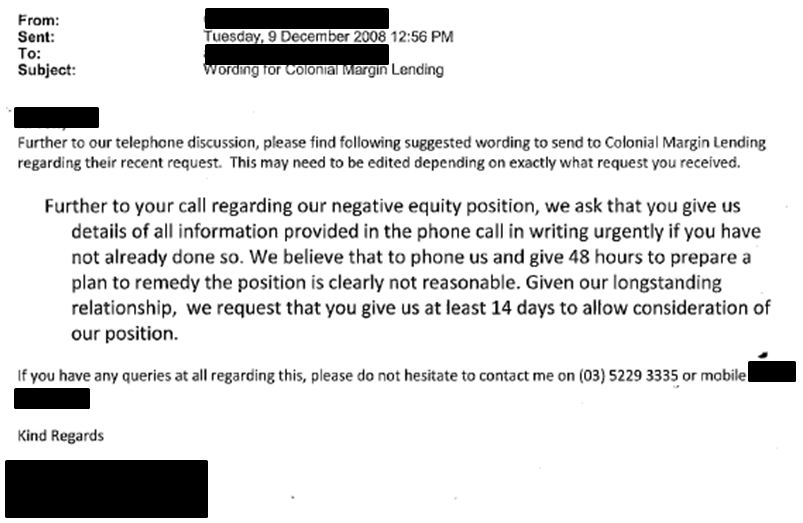

Following its previous attacks and unauthorised sell-downs in late Nov 08 and 4th Dec 08, the CBA then began on the 8th Dec 08 a carefully choreographed, scripted and brutal approach to recover funds from devastated Storm clients whilst laying off blame for the catastrophe onto Storm. These 8 Dec 08 CBA phone call scripts were carefully timed to be reinforced by the misleading statements in CBA’s letters (8th Dec 08, 9th Dec 08 & 17th Dec 08) which also commenced on 8 Dec 08.

Storm armed with their own client reconciliations and knowing that the banks calculations were profoundly wrong asked its clients to request a CBA reconciliation to confirm the banks demands and any amounts claimed to be still outstanding and owing to the CBA. The Plain Truth has found upon analysis that in many cases the CBA owed the Storm clients a refund and not the other way around as the CBA claimed. By 9 Dec 08 clients portfolios were completely in disarray and many were seeking guidance from Storm on how to react to CBA demands. Below is an email (one of many) from Storm to one of its clients proposing a possible course of action to assist them.

Sometime in the days before the 12th Dec 08 the CBA approached ASIC for their cooperation to help gag Storm because advisors were informing clients about the true scope of CBA’s wrongdoings and CBA wanted a clear run to collect as much money from client accounts as they could. To that end CBA crafted a story which ASIC accepted that Storm was at fault and that…

“Storm provided financial product advice to geared clients in margin call, that they request from the margin lender a 14 day period to consider their position. In doing so Storm may have mislead clients by failing to advise them of the consequences of such action.” Extract from enforceable undertaking demanded by ASIC from Storm

This contact between CBA and ASIC led to an investigation being commenced by ASIC into Storm Ltd on the 12th Dec 08 and the above extract from ASIC’s proposed Enforceable Undertaking (EU) demanded from Storm identifies the main excuse that ASIC used to gag Storm and its advisors in late 2008. The ‘consequence’ referred to in the above extract is that if clients where to take an additional 14 days, then they could possibly be up for a little bit more accumulated interest on their margin loan. This ‘accumulating interest’ red herring was the justification that ASIC used to prevent Storm clients from getting a proper reconciliation, never mind the huge errors in CBA’s figures. This also was the spin that CBA pushed onto ASIC and that ASIC needed to hear in order to gag Storm. The fact that almost all Storm clients had fixed and prepaid their margin loan interest in June 08 was conveniently overlooked. The irony was, that ASIC having nothing of substance against Storm and all culpability pointing toward the CBA ultimately had to go outside its own jurisdiction to fabricate an excuse. ASIC had no jurisdiction over margin lending. Perversely The Plain Truth has been told by many former Storm clients that when they complained to ASIC about the bank, ASIC told them that it had no jurisdiction over the bank or banking products (which includes margin lending).

“Margin lending facilities are not regulated as a financial product, or subject to Australian Securities and Investment Commission (ASIC) supervision relating to financial services. This is because the term ‘financial product’ in the relevant legislation does not cover credit products (such as margin loans) as a result of the current referral agreement with the States and Territories. Further, State and Territory legislation governing consumer credit (the Uniform Consumer Credit Code) excludes investment loans such as margin lending.[6]” – Treasury, Supplementary Submission 56, p 2.

To have considered these facts would have rendered ASIC’s justification for its gagging of Storm impotent.

Whilst ASIC has always denied that they were prompted by CBA to investigate Storm or that there was any discussion between ASIC and the CBA about Storm in the 2 weeks prior to the 12th Dec 08 it is now clear that there was extensive collusion between CBA and ASIC during this period. This was confirmed in conversations held on the 15th April 2009 and then again on the 27th April 2009 between a member of the SICAG committee and Debra Koromilas formerly of ASIC. Debra confirmed that ASIC did in fact gag Storm AND that the gagging was a consequence of information bought to them by the Commonwealth Bank. That Storm was gagged continued to be denied by Mr Tony D’Aloisio in evidence to the Senate estimates committee on the 4th June 2009 some than 2 months after the truth was revealed. An absolute and direct lie.

The Plain Truth has found no evidence to support ASIC’s allegation that Storm told clients to not deal with the banks. Equally The Plain Truth has found no evidence to suggest that Storm could sue the CBA on their clients’ behalf. If a suggestion the bank be sued was in fact made then it stands to reason that any such suggestion would involve a client suing the bank to recover losses caused by the bank…and of course what would have been wrong with that. Storm did attempt to take a supporting action (i.e. to sue the CBA for misleading and deceptive conduct) with the federal court finding the CBA had a case to answer.

If evidence did exist supporting ASIC’s concern then it would stand to reason that ASIC would have been more than willing to provide this evidence during the various meetings with The Plain Truth, Storm, or during any parliamentary hearings. Alternatively CBA would have made sure such damning evidence against Storm would have found its way to the press.

Once again all evidence is to the contrary. The Plain Truth analysis and expert advice was unable to materially fault the Storm advice to its clients in Dec 08 and was unable to see what was unreasonable with this advice as ASIC alleged. The attached email advice dated 17 Dec 08 was disseminated by Storm to its clients. The Plain Truth asks: Do you think the advice is unreasonable?

It is also quite clear from the ASIC email dated 9 June 09 that ASIC’s intentions were to place Storm in the worst possible light. Not only was Storm offering reasonable and sound advice to its clients at the time but we can only infer that ASIC’s position was driven by its desire to shield CBA’s unethical and illegal behaviour.

Coming article – The Plain Truth includes ASIC emails and documentation showing how ASIC actualised the gagging Storm in late Dec 2008

In light of ASIC’s ongoing denial that they were instrumental in gagging Storm it is important that as many former Storm clients and interested parties as possible, contact ASIC and ask the question:

“Did CBA approach ASIC prior to the 12th Dec 08 with information on Storm?”

“Was ASIC instrumental (in any way whatsoever) in preventing Storm advisors in engaging with Storm clients in Dec 2008?”

“Would you please tell us how many complaints ASIC received about the CBA from Storm clients and how many complaints did ASIC receive about Storm from Storm clients in the period from 1 Dec 08 to 1 July 09.”

If ASIC refuses to answer or gives waffle, then you know they are being deceptive. There is no legal reason why they can’t give you an answer and don’t fall for the old, ‘there is still an investigation in progress’ spiel.

For those of you interested in holding ASIC to account here are the contacts and please, please make sure you keep a record of the time and date of any conversation, who you spoke to and the details of your discussion. The best way to do this is to get yourself a little digital recorder, put your phone on speaker and hit the record button otherwise keep a written record. Please forward to The Plain Truth through our contact us tab the details of your conversations. Thank you.

Phone: 1300 300 630

Email: [email protected]

ASIC

PO Box 4000

Gippsland Mail Centre VIC 3841

Content : ASIC gagging, ASIC Hugh Copley, Storm clients, CGI margin call, ASIC Tony D’Aloisio statements, SICAG article

Documents

2008.12.08 d CML letter to client re negative equity

2008.12.09 d CML letter to client re Storm instructions to sell

2008.12.17 d CML letter to client re Storm

2008.12.17 e Storm email to client re addressing CML demands

2009.04.30 e SICAG email confirming ASIC gagging

2009.05 e SICAG article confirming gagging of Storm

2009.06.09 e ASIC email denial of Storm gagging

Comments are closed.