Reporter : Tom Tucker

Content : Storm advice, Storm / CBA compensation, Conservative advice, CGI margin call notice.

Tuesday 11th September 2012

One of the most difficult concepts I have had to write about exists in the apparently innocuous and seemingly obvious notion of whether Storm advice to its clients was conservative or not. The difficulty in addressing this issue stems from its abstract nature. It is this nature that allows parties to launch an argument which appears to be grounded and seems to contain plausibility when in fact the argument relies on the subjective assessment that each person places on the term conservative'.

After doing the research for this article I was compelled to write my conclusion first and then fill in the body of my work.Â

Einstein once said…All things are relative.

Because the term conservative is a relative term, the situation it describes in this case [Storm advice] must be compared to something else before it, or anything, can be described as conservative. Here is the core of the analysis problem. An elephant is huge…compared to an ant, but small…compared to a Blue Whale. The dilemma now is ' how does one describe an elephant? Is it big, or is it small? Clearly an elephant can only be described relative to something else.

Similarly was Storms advice to its clients conservative, or not? After researching this topic I have concluded that this notion as it relates to Storm advice has no significance, does not matter and is quite irrelevant. Neve-the-less I will now proceed and fill in the facts, given I have already put in the hard yards.

The law takes no issue with whether financial advice is conservative or aggressive. Indeed the law makes no distinction between good advice or bad advice. It allows for all advice. If any legal criticism is to be directed at Storm it can not be done so on the basis that its advice was not conservative.  Such criticism can not even be levelled if the advice was bad. Legal criticism can only be levelled at Storm if the relevant disclosures required in its advice were deficient or defective. Accordingly the sole question that needs to be addressed it, whether Storm made the appropriate disclosures'.

It is by now well recognised that only 1 in 4 people who had contact with Storm took on their advice whilst 3 out of 4 either did not find Storm advice suitable for them OR Storm saw the clients as unsuitable for whatever reason. As seen in our previous article “Investigation done on alleged Storm one-size fits all model†there is ample evidence to show that Storm declined to advise numerous people. Lightweight and glib arguments have been put forward that the 1 in 4 who took Storms advice were either greedy' or stoopid' or both whilst the 3 out of 4 who walked away were the smart ones'. Such arguments are so devoid of intellect and factual foundation that those comments can only come from either the feeble minded and / or those with an axe to grind. The truth is often inconvenient but nevertheless remains the truth and should always reign supreme.

The Plain Truth has done extensive analysis on Storm material in our possession which includes full copies of the Education Seminars, various Investor Updates and many Statements of Advice (SoA). What we found that was unique to Storm was the overweight emphasis to the various risks involved when compared to SoA's from other dealer groups. The information and knowledge provided was extensive and relevant with no punches pulled when describing risk whilst at the same time there was a clear absence of exaggerated promises and expectations.

Following you will find some examples of the types of disclosures emphasised by Storm. These examples are but a few and are by no means exhaustive.

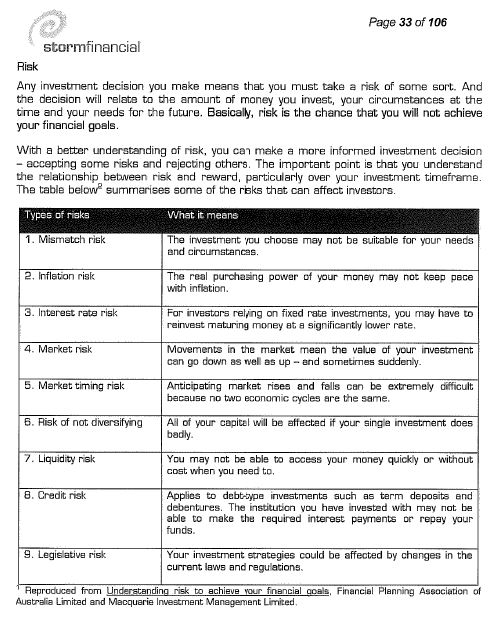

Extract from Storm Statement of Advice – identifying some risks

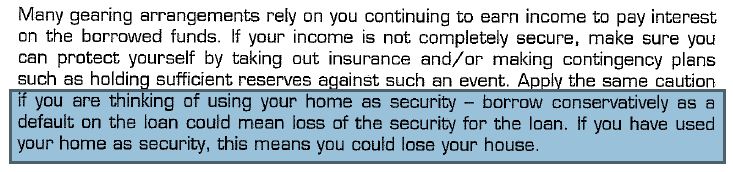

Extract from Storm Statement of Advice – consequences of default

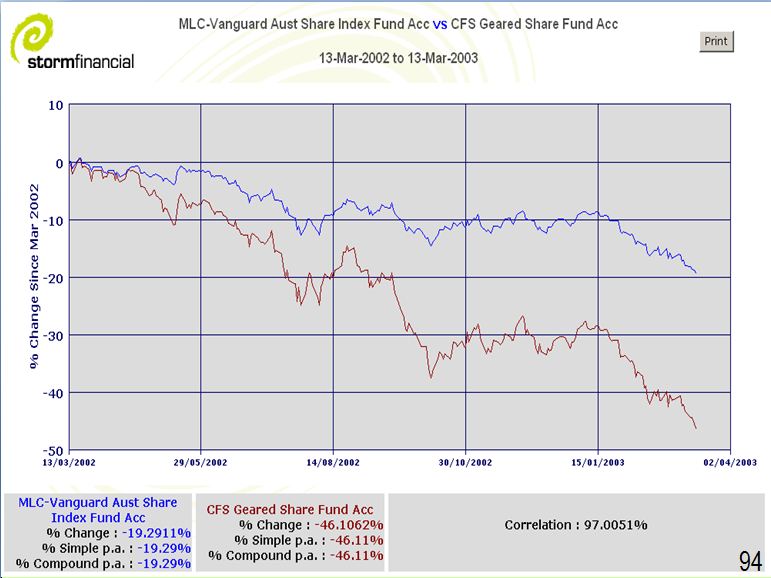

Extract out of Storm Education Seminars showing negative impact of geared v non-geared portfolio

Furthermore, our analysis of the Storm Statement of Advice could only find the use of the word conservative in 3 places. Each of these places applied the term conservative' appropriately and properly as follows.

1)     When describing the assumptions in Storms viability test, Storm claims that the assumptions made were conservative. In order to test whether the assumptions were conservative we tested each assumption (e.g. interest rates, distributions figures, returns, tax rates etc) relative to its benchmark as would be required by Mr Einstein. We found that indeed each assumption was discounted or inflated to impact negatively in Storms stress tests, therefore making Storms ASSUMPTIONS conservative.

2)     When talking about gearing, Storm was urging in its advice to err on the side of caution and borrow conservatively' to reduce the possibility of default. “Apply the same caution if you are thinking of using your home as security ' borrow conservatively as a default on the loan could mean loss of the security for the loan. If you have used your home as security, this means you could lose your house.â€

3)     Again Storm urged a conservative LVR (among other things) as a mechanism to reduce the likelihood of a margin call occurring. “The best way to avoid margin calls is to be conservative in the amount you borrowâ€.

Given these findings, the comments that Storm claimed to issue conservative advice' was a surprise. When looking at the disclosures no such claim of conservatism' was found, nor did Storms documentation claim that its advice was aggressive'. Rather Storms advice models a scenario as an option and ensures that the appropriate disclosures are made with an overweight emphasis on negative aspects whilst down playing any positives.

So, Why the criticism when the facts do not support such criticism?

All at The Plain Truth after considerable discussion unanimously agreed that there was little wrong with Storm's advice to warrant the criticisms levelled at it. The reality is that many people were substantially hurt and the vacuum created by CBA's actions in shutting Storm down left the banks as the only avenue for compensation.

This advantage contrived by the banks meant that conditions for compensation could ONLY be determined by the banks that offered compensation even though the compensation was only token. Accordingly the banks orchestrated a condition for compensation that required an acknowledgement by those hurting that a) the bank was in no way at fault and b) that Storm indeed was to blame.

In a nutshell the entire Storm / CBA problem was caused when the CBA system failed to issue margin call notices as it previously had done. This in turn prevented from implementing its protection strategy, as it had done in previous crashes (see article ' Storm Financials reparticipation strategy). The CBA's cunning cover up was to shift the blame onto an entity that had no voice because CBA was able to force Storm into administration and silence.

All of this manoeuvring by the CBA left the CBA with the only voice and the ability to dictate the minimal level of compensation it would pay for its mistakes. Accordingly regardless of what each Storm thought or believed after the collapse, they were left in a position where they either towed the CBA line (to receive compensation) or were left out in the cold.

The Editor

The Plain Truth,

PO Box 2783

New Farm QLD 4005

Content : Storm advice, Storm / CBA compensation, Conservative advice, CGI margin call notice.

Comments are closed.