Reporter : Ted Baxter

Content : CBA annual profits, PJC on Corporations & Finance, cause of GFC, Managed Fund MER’s

Tuesday 8th May 2012

Congratulations to Bernie Ripoll whose greatest claim to fame as the chairman of the Parliamentary Joint Committee on Corporation and Financial Services is to licence banks with the unfettered right to charge what they want, when they want, to whom they want. If sex, drugs and rock'n'roll were the temptations in the nightclubs of the 60's, 70's and 80's then greed, double greed and greed10 are the demons of today with the bank boardrooms being the nightclubs.

Researching this stuff and reporting on it can be so soul destroying if one allows it to be. Looking at the cold hard facts, the actions of various organisations and the consequences of these actions on people with hearts and souls is a very sobering experience. For the purposes of this report the facts are as follows:

-Â Â Â Â Â Â Â Â Â A global financial crisis swept the world in late 2008.

-         The nature of the crisis led to the greatest destruction of capital and liquidity in human history. The consequence of this destruction of liquidity was the triggering of a deleveraging event within the capital markets of seismic proportions.

-         The extent of the loss of liquidity resulted in banks worldwide falling into insolvency like dominos. The consequences of this banking insolvency crisis meant that the global economy was in serious meltdown and had crossed the point of no return. This in turn meant the inevitable breakdown of society as we know into anarchy.

-Â Â Â Â Â Â Â Â Â The only and final option available to societies was for sovereign intervention to occur in order to prop up the system by saving the banks.

-Â Â Â Â Â Â Â Â Â Now here is the galling part. THE CAUSE OF THE GFC WAS THE GREED DRVEN ACTIVITIES OF THE BANKS THEMSELVES WHICH THEN REQUIRED DEFIBRILLATION'.

-Â Â Â Â Â Â Â Â Â The activities required to restart the heart of the banking system, which caused the GFC and the pain emanating from it, involved such massive injections of capital that in many cases required the undisguised, raw printing of new money which has been cutely and Orwellianly described as Quantitative Easing' (just more taurus excretes).

-         Q: Who pays for all of this? A: We all do. The taxpaying plebs at the end of the food chain.

-Â Â Â Â Â Â Â Â Â Q: How do we pay?

- Stage 1 ' We pay via the transfer of our wealth back into the banking system to help save them ' i.e. our assets were force sold out from under us to rebuild the banks stockpiles of cash which they had burnt up in sub-prime assets.

- Stage 2 ' Insult is then added to our injury by demanding of us as taxpayers to fund massive and incredible bailouts in addition to having involuntarily contributed most of our existing wealth when the bank stole our assets ' i.e. governments are running deficit budgets which will have to be funded from direct and indirect taxes already impacting on our lifestyle ' e.g. increases fuel costs, property rates, statutory fees and charges, electricity, transport, medical, blah blah blah.

- Stage 3 ' Because of the nature of Quantitative Easing the only outcome from this process is an increase in the cost of living (extra inflation) because printing new money does not actually increase real wealth.

Question: Who are the beneficiaries from all of this?

Answer : Not you, me or your neighbour. Not even the government. The only possible beneficiaries are the banks. The following table highlights the annual statutory NPAT (Net profit after tax) of the Commonwealth Bank from 2004 to 2011 inclusive along with the latest half year profit reported as at 31 Dec 2011.

These results carry their own message. The world economies have come apart and are still disintegrating in much of the world whilst an institution like the Commonwealth Bank goes from strength to strength to strength. Please note that the latest half yearly results are greater than the entire full year results of 2004 and almost to the level of the full year results for 2005 and 2006.

These results carry their own message. The world economies have come apart and are still disintegrating in much of the world whilst an institution like the Commonwealth Bank goes from strength to strength to strength. Please note that the latest half yearly results are greater than the entire full year results of 2004 and almost to the level of the full year results for 2005 and 2006.

The public is poorer, the government budget has gone from surplus to deficit yet the CBA robber barons along with the other banks are getting fatter and meaner. As is the custom with facts they speak for themselves however none are so blind as those who do not want to see.

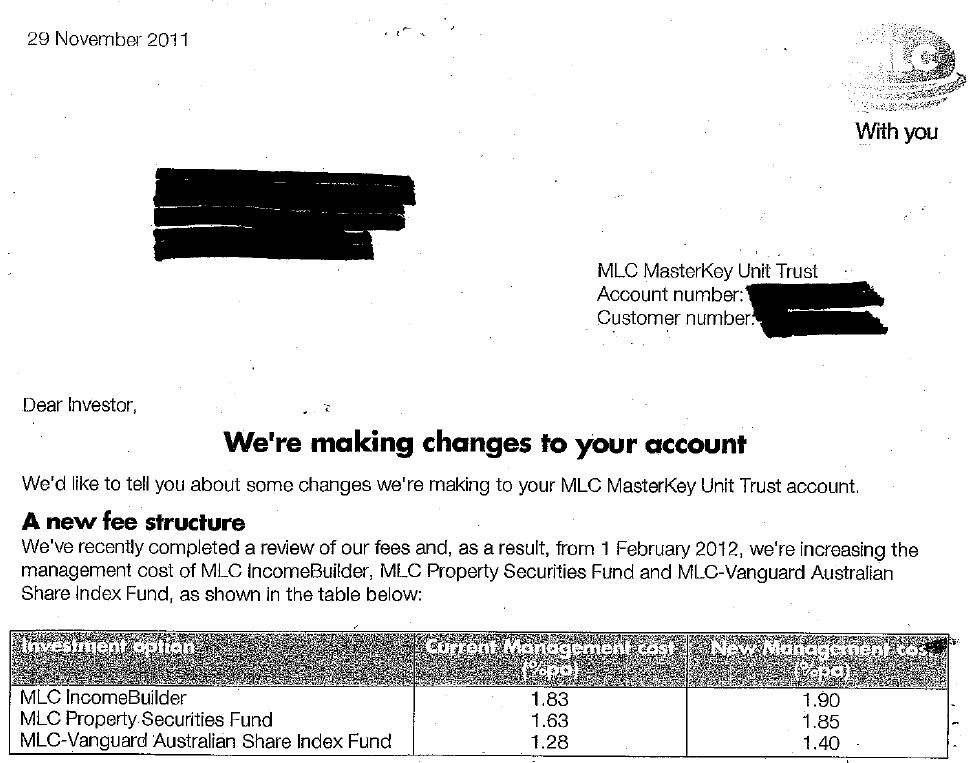

Recently a Stormie forwarded to The Plain Truth a communication received from the National Bank. This communication very clearly reveals one of the outcomes from the Parliamentary Joint Committee Inquiry into Financial Products and Services. Following is a copy of this communication and a quick look over it highlights three things:

1)Â Â Â Â Â The NAB / MLC is further moving towards self service aided by the incredible power of the internet. By having accounts online as you can see some of the services such as updating details, making contributions, accessing reports and printing one's own statements (on your own paper and with your own ink) will cut the banks expenses significantly. This also eliminates postage and reduces staffing requirements.

2)Â Â Â Â Â Furthermore by having individuals process their own transactions the bank is able to transfer away from itself all liability with respect to these transactions.

3)     At the same time that the bank is reducing its costs it has the audacity to demand and get higher annual ongoing fees. Please note that these higher annual ongoing fees which include advisor trail commissions are being increased in an environment where advisor trailing commissions may disappear (FOFA reform) possibly leaving the poor bank with extra profit that they are just going to have to live with. Such is life.

Demonstrably all that the Parliamentary Inquiry has managed to achieve is to perpetuate the impunity with which the banks / Commonwealth Bank can conduct themselves. As we all know lessons in life come with a price and of course we Stormies have been subjected to many lessons at a heavy price. Unfortunately some of us are still to understand the lesson even though our hurt is profound. The banks on the other hand as you can see from their profit increases have been allowed by the legislators to pass on all of the hurt to the rest of us and feel none of it themselves in spite of the fact that they are the root cause of the hurt. These smiling bandits are laughing all the way to the bank.

Today's story is further evidence that the Parliamentary Joint Committee on Corporations and Financial Services really had no interest in pursuing any bank let alone the Commonwealth Bank. Further evidence of this mindset can be seen in the opening gambit of the inquiry where the Commonwealth Bank was completely left out of the PJC Terms of Reference. This mindset was also reflected in the final 11 recommendations from Bernie Ripoll, not one of which included that accountability be demanded of the CBA or any other bank.

The Editor

The Plain Truth,

PO Box 2783

New Farm QLD 4005

Content : CBA annual profits, PJC on Corporations & Finance, cause of GFC, Managed Fund MER’s

Comments are closed.