Reporter : Ron Burgandy

Content : Colonial Geared Investments LVR, Storm clients, PJC Bernie Ripoll, Colonial Margin Calls

Tuesday 24th April 2012

…This article follows on from my latest story “Commonwealth Bank ' Determined to be different – Bank grabs PJC lifeline of ignorance' †where the CBA was exposed omitting key critical evidence to the Parliamentary Joint Committee.

The effect of this omission was to mislead the PJC into concluding that the CBA had acted properly because it had no strict contractual obligation to issue a margin call notice. Whilst this was true, the CBA did not offer, nor did the PJC search for the information showing that the CBA was compelled to issue a notice prior to any sell-down of client assets. The CGI margin loan terms & conditions clearly required a notice be issued to borrowers before any of the borrowers assets could be disposed of by the bank. This legal requirement to issue a notice prior to asset disposal rendered all CBA selling of borrowers assets where the borrower did not specifically authorise the sale, illegal.

Whilst investigating the above issue The Plain Truth did an analysis on this borrowers account (among many others) and uncovered other valuable nuggets of information about your local friendly (not) CBA bankers.

It still amazes us to find that it is possible for rot to penetrate an organisation to such depths. As The Plain Truth uncovers one lie, the layers of lies that lay underneath seem to be endless. Furthermore, the quality of the Commonwealth Banks lies are so weak that they are able to be easily punctured. This brings us to another problematic question ' If the CBA's lies are so transparent and easily exposed, why then is this not being broadcast by Parliament, ASIC and the Press?' The reason can only be that the rot has infected areas much wider than The Plain Truth ever contemplated.

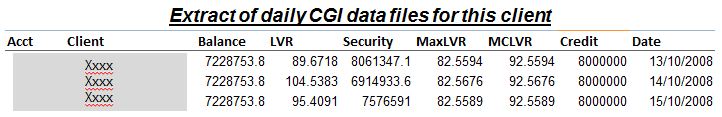

The data below that was provided by the CBA to one of its victims includes more cunning deceptions than simply a weak attempt at passing off a one-liner' as a margin call notice.

The following points should be noted regarding this alleged margin call notice:-

a)Â Â Â Â Â The data provided by CGI was clearly wrong.

b)     The Plain Truths expanded CGI data extract below shows the above information that was provided to client. On 15th Oct 08 the client LVR was 95.41% with a margin call LVR of 92.56%.

c)Â Â Â Â Â The Plain Truths expanded CGI data which the bank did not provide to the borrower also shows below that borrowers account went into margin call NOT on the 15th Oct as claimed by the CBA but on the 14th Oct.

d)     More significantly the CGI data very clearly indicates that not only was the client in margin call on the 14th Oct but also in negative equity. The borrowers LVR was a staggering 104.54% with a margin call LVR of 92.57%.

The purpose of the above analysis is not to test the integrity of the data but to show that with the CGI's own data (which The Plain Truth will again prove was wrong), the bank was forced to extend the layer of lies in order to cover up the negative equity issue.

This now brings The Plain Truth to the next layer in this seemingly small point which is in fact pivotal to the truth.

The Plain Truth forensic investigators have also calculated that the actual / true margin call for this client occurred on the 8th Oct 08 when the true LVR was at 94.63% and the margin call LVR was at 90% and not on the 15th Oct as claimed by the Commonwealth Bank to its borrower OR on the 14th Oct as shown by the banks own data which has now proved to be wrong.

For the readers information

– On the true day of margin call (8th Oct) CGI data indicates that the LVR was 87.22% and the margin call LVR was 92.49%. A buffer of 5.3%.

– On this same day the actual data indicates that the LVR was 94.63% and the margin call LVR was 90%. In margin call by 4.6%.

In other words the CGI data was indicating that this account was safe' by 5.3% when in fact it was in margin call by 4.6%. This is a difference of nearly 10%.

These differences between the CBA's claims to the borrower and the reality of the borrowers situation made the difference between financial life and death. The CBA was completely responsible for this, not the borrower, not the advisor and not Storm as the CBA attempted to make this borrower believe.

The Plain Truth has conducted hundreds of similar analyses on Storm client portfolios showing that CBA's data was wrong in all cases. For the purpose of clarity and to remove all doubt The Plain Truth stands behind the view that each and every CBA borrowers margin loan data details was profoundly defective.

These most important points were not investigated by the PJC and completely ignored by the Parliamentary Joint Committee Chairman Bernie Ripoll. A possible reason why Mr Ripoll failed to probe these critical issues may have been because he lacked sufficient intellect to understand the matter of the Inquiry. A more sinister view and one to which The Plain Truth subscribes, may be that Mr Ripoll deliberately and knowingly side-stepped these most relevant CGI terms and conditions in order to shield the CBA. Either way a monumental miscarriage has occurred desperately requiring a proper and better focused Parliamentary Inquiry for justice to be served.

The Editor

The Plain Truth,

PO Box 2783

New Farm QLD 4005

Content : Colonial Geared Investments LVR, Storm clients, PJC Bernie Ripoll, Colonial Margin Calls

Comments are closed.