Reporter : Jimmy Olsen

Content : CGI margin loans, Storm clients, Commonwealth Bank errors, ASIC compensation

Tuesday 5th June 2012

We have already seen how Storm had developed a re-participation strategy to cope with highly volatile and deeply negative markets. Similarly Storm entered into a pact with the Commonwealth Bank in the early 2000’s to work in close cooperation with them in the event that serious errors occurred. This informal cooperation which we demonstrate in this article culminated in an attempt to formalise this cooperation in an agreement ratified 18th May 2007. We now know that the Commonwealth Bank sidestepped this agreement in 2008 and in doing so contributed to the destruction of Storm and its clients.

Between 2001-03 it was discovered CBA had error’s in its then margin lending system which, among other things, often under-allocated or over-allocated units to individual accounts. The effect of an over-allocation was to delay margin calls past the point where the margin call should have occurred, causing some clients to go into negative equity. Thanks to the ever increasing supply of statements that The Plain Truth has received it has been identified that one of the main reasons for the over-allocation of units was because when redemptions occurred the CBA system failed to remove those redeemed units. This overstated a client security position which gave the appearance that the account was in a stronger position than it actually was.

In addition to the failure to record redemptions the CBA also simply got its record keeping wrong because at that time the unit updating system was manual and not timely. Hence human error played a large part. Some of these additional types of errors involved recording an individual security / fund as collateral on another borrowers CGI margin loan and not on the correct loan OR alternatively recording the same collateral on two different borrowers loans. Accordingly this one error affected two borrower accounts simultaneously by overstating the units on one and understating the units on the other or alternatively correctly recorded the collateral on one account and overstated it on the other.

Given the large amount of material The Plain Truth has been provided with by Storm clients we have the luxury of selecting for an illustration which shows the client was not only the victim of one CBA mistake but subjected to two unrelated mistakes…AT THE SAME TIME.

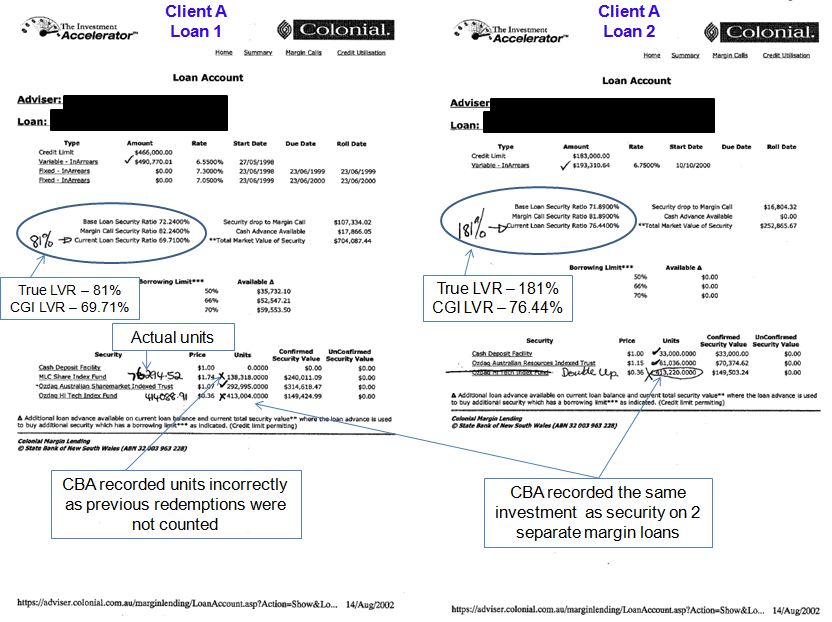

As you can see in the following illustrations the errors by the CBA are by no means trivial. Clearly these errors carry severe consequences should they not be acknowledged. However as you will see when reading on these CBA errors were acknowledged and accommodated by the CBA in 2002. Regrettably, similar errors in 2008 were not acknowledged with disastrous consequences. In the case of ‘client A’ loan 1, of the 2 loans that this client had simultaneously, you can see MLC units are overstated at 138,318 units when in fact the true balance of the MLC units at the time was 76,294. The consequence of this error was that the clients LVR was not a more moderate 69.71% as stated by Colonial Geared investments but rather a riskier 81%. This mis-information in the clients hands had the effect of making ALL activity in the portfolio which occurred whilst these mistakes prevailed dangerous and potentially fatal.

In addition to the error mentioned above ‘client A’ had one (1) ozdaq Technology fund whose 413,000 odd units (incidentally CBA also listed different unit balances for the same fund) were used as collateral for both of their Colonial Margin Loans (loans 1 and 2).

The consequence of the ‘doubling-up’ of client security was to effectively show the client LVR at 76.44% when in fact the client was severely in negative equity at 181%. Disaster was averted because CBA admitted its mistake which it should also have done in 2008 but did not.

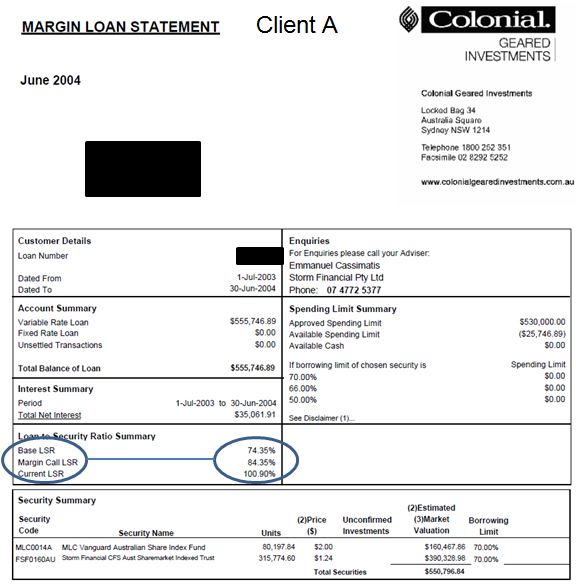

Note the managers of CBA at that time elected to acknowledge the CBA mistakes and did not destroy this or any clients to cover their position. Rather, CBA accepted that the client was in this negative position due to their errors and accordingly co-operated whilst the market corrected the situation (regardless of timeframe). This is clearly evident when viewing the same client position nearly 2 years later. Over this time the market had improved by 25%. CBA’s cooperation and tolerance of the situation is evident in the clients CGI statement below dated 30 June 2004. Not only were the clients still in margin call but they were in fact still in negative equity with a LVR of 100.90%.

There were many such negative equity cases which were a direct result of defects in the CBA system. However the management within CBA at the time namely Paul Johnston and Mark Corradi agreed that the fault lay with CBA. Following discussions with Emmanuel Cassimatis, it was further agreed between CBA and Storm that both advisor and bank work together to rectify the clients position. Accordingly all clients continued to get notices that they were in margin call, but no client was sold out. To their credit both Paul Johnston and Mark Corradi acted correctly and with integrity thus maintaining the good name of CBA.

Subsequent to this time it was business as usual and CBA went about further automating their system.

Following the CBA errors discovered in the early 2000’s Mr Cassimatis attempted to ensure that should such a set of circumstances happen again then the CBA would be obliged by agreement to work together with Storm in order to correct client positions. To not have such an agreement would continue to rely on the discretion of whoever was the margin lending manager at the time. At the same time this agreement was intended to formalise a number of elements of Storms re-participation strategy.

To this end a written arrangement between Colonial Geared Investments (CGI) and Storm was struck on the 18 May 2007. This arrangement will be the subject of a fuller analysis in future articles.

This discussion of the historical nature of the Storm / CBA relationship is relevant in understanding Storms expectations and mindset in 2008 and also in understanding how destructive the ASIC gagging of Storm in 2008 was.

The Plain Truth,

PO Box 2783

New Farm QLD 4005

Content : CGI margin loans, Storm clients, Commonwealth Bank errors, ASIC compensation