Reporter : Ted Baxter

Content : CGI terms & conditions, post-GFC banking sector, Commonwealth Bank news, Bernie Ripoll report, Senate Economics Committee.

Tuesday 3rd July 2012

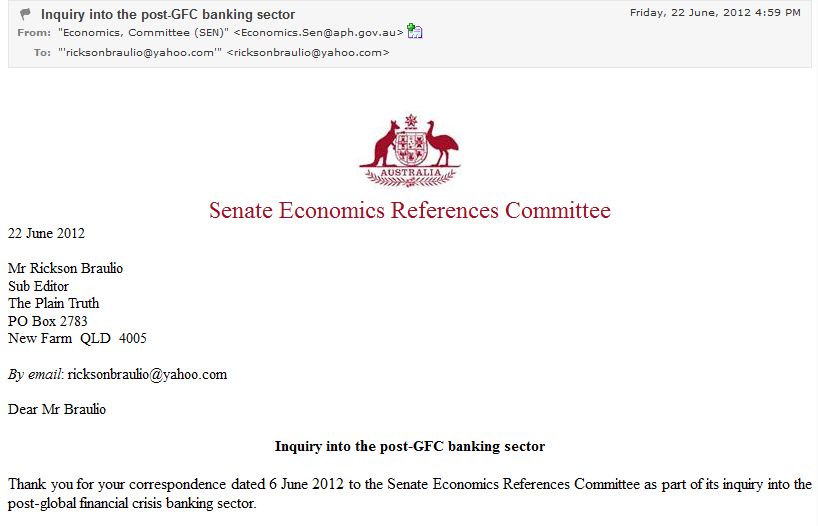

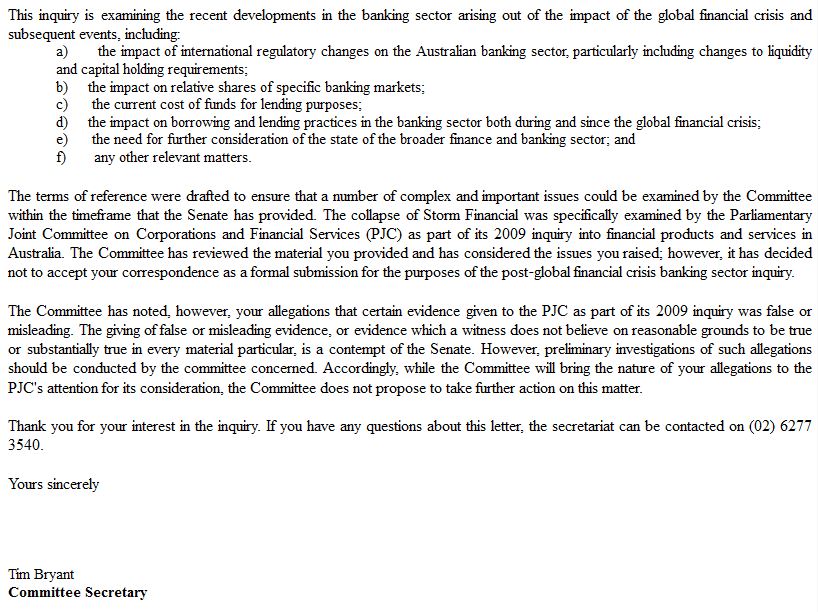

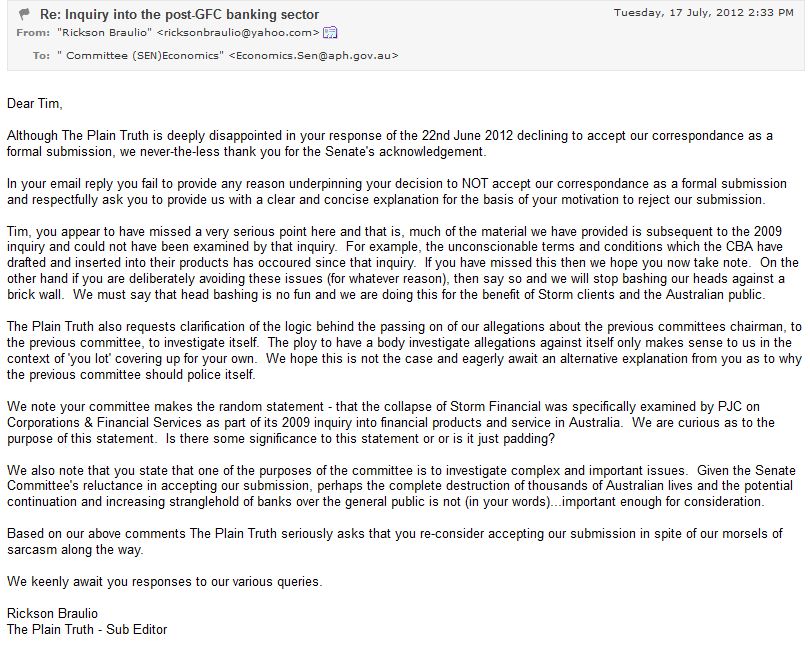

The Plain Truth was asked at the eleventh hour by Storm clients to assist with a contribution towards a submission to the Inquiry into the post-GFC banking sector. The following submission was made and forwarded to the Senate Economics Committee in the hope, but not the expectation, that the evidence presented would lead to a re-evaluation of the PJC’s 2009 flawed findings. However that would mean that someone in the Economics Committee would need to have a conscience.

Given the outright rejection by the Economics Committee and the elimination of privilege issues, The Plain Truth is now in a position to publish the full submission.

The grounds for the Committee’s rejection and our response will be published in the future

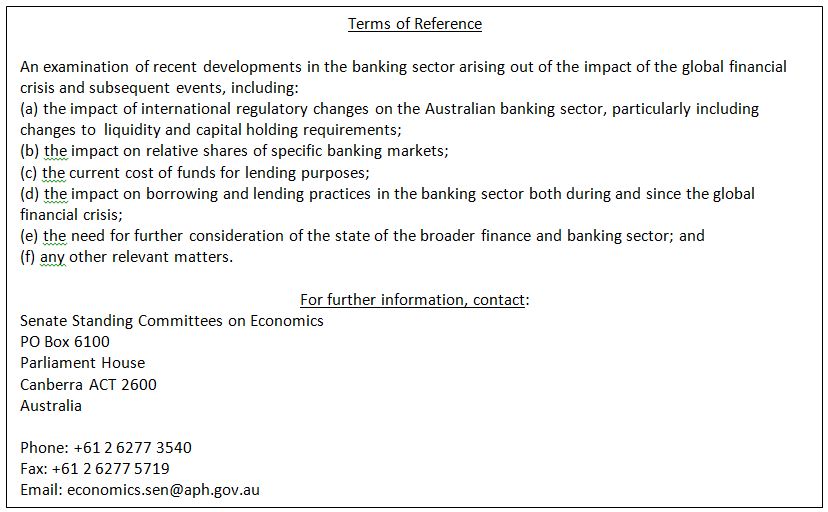

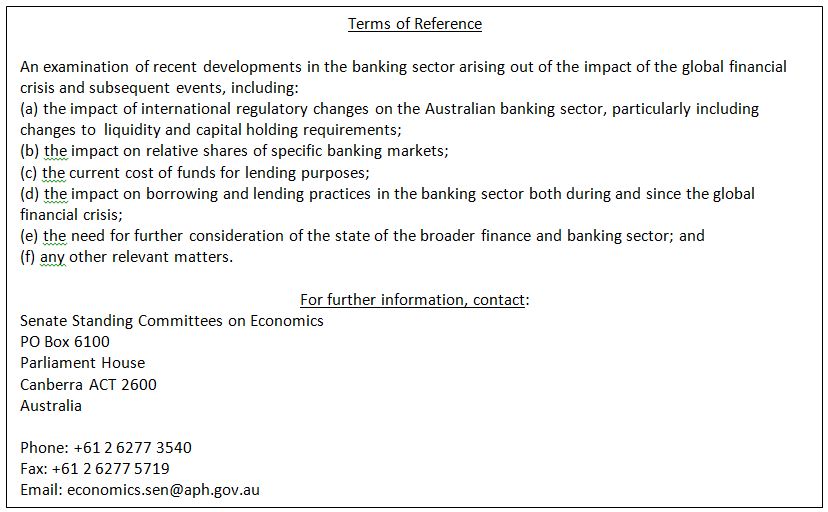

Below are the terms of reference for the inquiry into the post-GFC banking sector…

Due to the time constraints this contribution will be limited to the terms of reference related to –

(d) the impact on borrowing and lending practices in the banking sector both during and since the global financial crisis.

Preamble

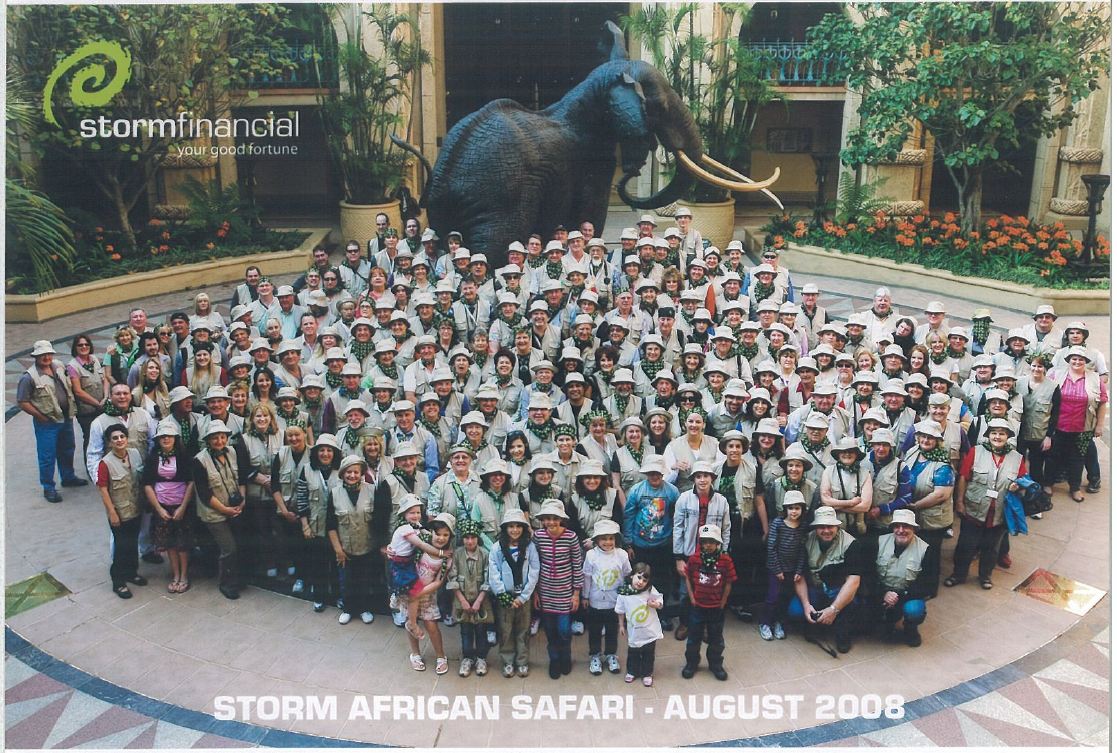

One needs to look no further than the collapse of Storm Financial to be able to isolate and view the extent of the powers that has been bestowed upon the banks by our Parliament. The mere possession of power in itself is not the source of corrupt practices but it is the way in which such power is exercised that can and often does enable corrupt activity with disastrous consequences.

Brief explanation of banking industries ‘crumple zone’

Modern motor vehicles have been specifically engineered to protect the driver by deliberately sacrificing the integrity of the vehicle. The most important element of this protection is the existence of ‘crumple zones’ which bend and deform to absorb the energy generated by an unforseen impact (often caused by the driver) and to prevent that energy from bending and deforming the driver. During this process, vehicle infrastructure gets destroyed but the driver can remain relatively unscathed. The fact that drivers have achieved higher levels of protection though such things as disc brakes, ABS, seatbelts, air-bags and crumple zones, means that they feel more confident in driving progressively faster and faster such that if an accident does occur at much higher speed its consequences are significantly more horrific.

In the above metaphor the GFC was the unforseen impact. The driver was the banks who have now been proven to have caused the impact with their sub-prime derivatives. And finally, the crumple zone was a mixture of the 3rd party organisations such as Storm Financial and its clients that the banks, in this case the CBA, used to absorb the impact of the crisis. Given that Storm Financial was completely destroyed along with many of the banks and Storms clients then the banks ‘crumple zone’ did the job it was designed to do…protect the bank.

Just as a vehicle driver feels more confident as the layers of protection around him increase, the banks felt confident to the degree of arrogance with the onset of globalisation, legislative protections (their own banking act) and the impunity bestowed upon them as a result of access to unlimited amounts of capital for their use within the legal system.

It is quite diabolical when one considers that the cause of the GFC were the banks yet not only are the banks untouched but are making record profits – how can this be?

Pre-GFC History – CBA and Storm – a typical example of bank conduct

Throughout the decade leading up to 2008, the CBA had formed a very close and acceptable cooperative relationship with Storm Financial to further the business interests of both parties. The benefits of this cooperation extended beyond the boundaries of just Storm / CBA and into their mutual clients. The extent of these client benefits included but were not limited to:

1) Discounted interest rates on margin loans – annexure 1a & annexure 1b

2) The waiving of establishment fees on bank loans – annexure 2

3) Discounted management fee on managed funds – annexure 3

4) A liberal interpretation of the margin loan terms and conditions during periods of high volatility – annexure 4

The single most important aspect of this cooperation emerged when it became apparent to Storm subsequent to the Tech crash and Sept 11 stock market volatility that the CBA had made significant errors in its margin loan records which resulted in untenable financial positions for numerous Storm / CBA clients. As should be expected the CBA at that time admitted to its errors, sought the assistance of Storm and proceeded to correct over time the positions of all those affected with the result that all parties, especially the consumers, were satisfied. A more comprehensive analysis of this point can be seen in annexure 5 or www.commonwealthbankdeception.com/?p=368.

Clearly when reasonable people such as David Murray (the CEO of the CBA at that time), Paul Johnson (the head of Colonial Margin Lending at the time) and Mark Corradi (the 2IC of Colonial Margin Lending at the time) are holding the reins of power then the exercise of such power is reasonable. In the early 2000’s when the CBA made an error, the drivers at the time chose to avoid a fatal collision with pedestrians (consumers) and took evasive action before an impact occurred thus saving the pedestrians.

Banking practice during the GFC – CBA and Storm – a typical example of bank conduct

In the case of CBA and Storm, what cannot be disputed is that the CBA is still standing with the backing of government guarantees, record profits and the spectre of continuing massive profits whilst Storm Financial no longer exists and its thousands of customers are financially devastated. What is also clear is that the bank has largely succeeded in deflecting the blame for its errors in 2008 and beyond and having the temerity to attempt to present itself to the world at large as a responsible citizen and a white knight.

In the lead-up to late 2008 the CBA had numerous errors in its margin lending data records (annexure 6a & annexure 6b). These errors had the effect of placing the banks and Storms clients in an untenable position as happened in the early 2000’s. In late 2008 when these errors again became apparent and were pointed out to the CBA, the bank elected to follow an exclusive path of self preservation rather than act in the proper and legal manner that it did in 2003. The bank chose the Machiavellian course presumably because it had inside industry knowledge of what was coming – the end DOES NOT justify the means. This raises the question “why would the bank in the way it did in 2008 rather than follow the reasonable precedent it had already set in 2003?” We believe the answer to this question is to look beyond the corporate veil and not look at the actions of the bank, but rather scrutinise the actions of those driving the bank. In 2003 Messers Murray, Johnson and Corradi were the responsible decision makers. In 2008 Messers Ralph Norris, Edward Tait and John Clothier unfortunately were at the helm.

It is no secret that all three of these men have in no way been held accountable for the irresponsible mis-use of the powers they held. Accordingly if no example is made of such people then all the laws and regulations in the world cannot touch those who have the power to act with impunity.

Banking practice subsequent to the commencement of the GFC

The following points are sufficient to recognise how the banking industry is able to take advantage of even the most adverse of conditions:-

a) Results speak for themselves. It would not be possible for the banks to sustain record profits through even the most adverse of conditions without legislative and other support enabling them to do so.

b) Attached annexure 7 is a self explanatory report from the Commission on Banking and Financial Services sent to the Board of the Commonwealth Bank on 15th Aug 2011. Broadly this report clearly identifies bank (mis)conduct that needs to be remedied.

c) At a more technical level we have been able to identify many areas where the banks have no fear of the consequences of unconscionable conduct and accordingly manipulate their terms and conditions making it impossible for a consumer to get a reasonable outcome for themselves in volatile circumstances. In other words, the banks have set up their contracts such that should the environment become adverse, they are fully protected at the expense of the consumers (an improved crumple zone). The following example highlights this most elegantly.

Since the commencement of the GFC, the Commonwealth Bank (in this example) and other banks have altered their terms and conditions to further extend their protection (crumple zone). Such alterations can only occur if they are allowed to occur and they know they can get away with them. Of course this demonstrates that the terms and conditions that existed at the commencement of the GFC did not support the horrific and devastating actions that the banks (CBA) took in relation to Storm clients. Hence the changing of the terms and conditions is a clear admission of guilt…should Parliament care to look.

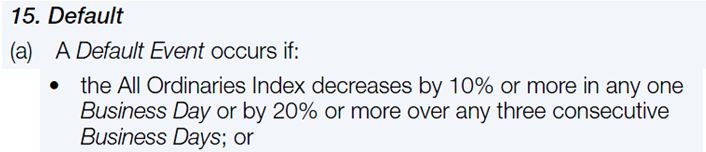

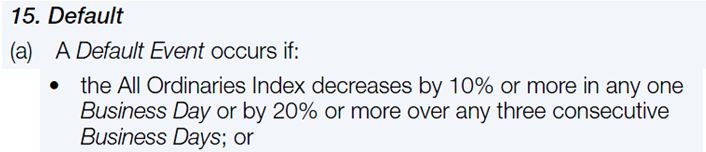

In this example the Commonwealth Bank added a new term in its CGI terms and conditions (from 2010 onwards) which would place ALL Colonial margin lending borrowers in default of their loans merely because the All Ordinaries Index falls either 10% in a single business day or 20% over any three consecutive business days whether the borrowers owe the bank money or not.

The extraordinary power that this simple sentence gives the bank is beyond comprehension.

a) If a borrower has a margin loan secured against cash and other assets which remain unaffected by the equities market then this borrower would without cause be in default just because the All Ords fall 10% in one day, which has happened on numerous occasions.

b) If a borrower has a margin loan with securities attached and not anywhere near margin call, the bank would still have put them in default should the All Ords fall 10% in one day.

c) If a borrower has a margin loan and finds themselves in margin call and remedies the margin call in the time allocated by the bank, the bank would still have this borrower in default regardless of what the borrower did.

The banks power is now so overwhelming that…

d) A borrower who has an open margin loan, with a nil balance (that is the borrower owes the bank nothing) then the bank would still place this borrower in default should the All Ordinaries fall 10% in a single day even though the bank has no exposure to this borrower (since the borrower owes the bank nothing) but only technically has a margin loan account open for possible future use.

Extract from page 9 of CGI Terms and conditions effective 1 July 2010. This is the first time this clause appeared in the Colonial Geared Investments terms and conditions.

Once a default occurs the relevant bank has bestowed upon itself numerous rights to exercise at will against the person in default. Similarly the person in default has reduced rights and a significant potential negative impact on their credit rating.

The power that the bank confers upon itself with the above 25 words is unconscionable. Furthermore these 25 words although highlighted here and readily identifiable for you are buried in a document containing thousands of words – find the needle in the haystack if you can. This is but one example of hundreds.

Tactics and techniques the banks use to avoid scrutiny

1) Anonymity – It is very easy for individuals within the CBA to shoot at and pick off exposed individuals from behind their armoured barrier when they know no-one can shoot back at them. Faceless and nameless individuals within the CBA made the unlawful decisions that led to the destruction of thousands of former Storm clients, the destruction of Storm itself, its advisors and staff and the good reputations of Storms advisors and staff. The contemptible behaviour of these CBA individuals was so pervasive that it was able to taint other organisations such as the Financial Planning Association (FPA), Macquarie Bank, Wesptac, National, ANZ, Bank of Queensland etc. Below are some of the CBA individuals who were directed by Ralph Norris and who were prepared to carry out whatever acts were required to obliterate Storm clients and Storm itself from the face of the earth.

The following individuals within the CBA, among others, form the core of those responsible for the greatest fraud in Australia’s banking history: Bernie Ripoll (no, this is not a typo), Ralph Norris, Ian Narev, Ross McEwan, Edward Tait, Brian Phelps, Robert Ralston, John Clothier, David Cohen, Charles Tilley, Matthew Comyn, Brendan French and Bernie Ripoll (no, this is not a typo) to name a few.

2) Unlimited financial resources – As we all know the power is in the money. Those wrong-doers within the CBA have access to CBA’s bottomless pit of dollars and the will to spend those dollars protecting themselves. This immense financial lever allows them to buy the services of the most cunning lawyers, barristers, influences of the press and other organisations. Compound this financial power with the corresponding financial weakness (which the banks orchestrate) of their opponents and you have a winning formula.

3) Ability to control organisations and individuals – This ability of course comes from the CBAs unlimited financial resources. When one mixes an individuals or an organisations greed or need with the corresponding liberal availability of cash, then the ability to influence becomes irresistible. This phenomenon became apparent in an analysis on the frequency of negative press about Storm. It was found that there was a statistically significant correlation between when negative Storm press was published and the inclusion of large expensive Commonwealth Bank advertising spots.

4) Political clout – The mechanisms of political clout remain a mystery to us mere mortals. What we do know is that lobbying occurred, favours got exchanged and commitments were made. Although the average person can not see or fully appreciate all aspects of this political clout, one is able to comprehend its purpose and existence by observing outcomes.

In late 2008 and early 2009 the call went out for a Senate Inquiry into the banking industry. This was driven by the collapse of Storm and the role of the Commonwealth Bank that led to this collapse. Senator John Williams prompted by hundreds of distressed Storm clients was the driving force behind the establishment of a Senate Committee of inquiry about the banks.

Ralph Norris became very alarmed at the prospect of an inquiry into the banks which would have exposed his and the banks role. To protect himself and the bank Mr Norris used the banks power to lobby and completely quash ANY reference to the banks in the inquiry and in particular to the CBA. The government through the Labor party was extensively lobbied resulting in Bernie Ripoll hijacking the inquiry from the Senate and making it a Parliamentary Joint Inquiry which he as a member of the Labor government chaired, rather than a Senate Inquiry which the more impartial opposition would have chaired.

The inconvenient truth of this can be seen in the complete absence of any reference to the banks or the CBA in the original terms of reference of the inquiry.

On 25 February 2009 the Parliamentary Joint Committee on Corporations and Financial Services resolved to inquire into and report by 23 November 2009 on the issues associated with recent financial product and services provider collapses, such as Storm Financial, Opes Prime and other similar collapses, with particular reference to:

1. the role of financial advisers;

2. the general regulatory environment for these products and services;

3. the role played by commission arrangements relating to product sales and advice,

including the potential for conflicts of interest, the need for appropriate disclosure, and remuneration models for financial advisers;

4. the role played by marketing and advertising campaigns;

5. the adequacy of licensing arrangements for those who sold the products and services;

6. the appropriateness of information and advice provided to consumers considering

investing in those products and services, and how the interests of consumers can best be served;

7. consumer education and understanding of these financial products and services;

8. the adequacy of professional indemnity insurance arrangements for those who sold the products and services, and the impact on consumers; and

9. the need for any legislative or regulatory change.

This corrupt and blatant carve out from the inquiry of any reference to the CBA and the consequent immunity that this carve out afforded the CBA led to a revolt within the electorate at this injustice.

The consequence of this revolt by CBA’s victims and others, forced (reluctantly) the inclusion of the banks in the inquiry. However the CBA was still able through Bernie Ripoll to suppress any mention of the CBA specifically in the new terms of reference even though there was a weak and anaemic reference made about the involvement of the banking and finance industry. The following extract from the amended terms of reference show this to be the case.

On 16 March 2009 the Senate agreed that the following additional matter be referred to the Parliamentary Joint Committee on Corporations and Financial Services as part of that committee’s inquiry into financial products and services in Australia, adopted by the committee on 25 February 2009 for inquiry and report by 23 November 2009:

The committee will investigate the involvement of the banking and finance industry in providing finance for investors in and through Storm Financial, Opes Prime and other similar businesses, and the practices of banks and other financial institutions in relation to margin lending associated with those businesses.

Furthermore this Inquiry should note that EVERY sitting of the 2009 PJC Inquiry, the banks were excluded from the Terms of Reference of each and every sitting.

Clearly banks are a power unto themselves with the Banking Act of 1959 affording special and favourable consideration and allowing them to NOT be subject to many of the normal laws that the rest of us are subject to. There is however one thing from which the banks can not escape and that is…The TRUTH. The weapons at their disposal are powerful and destructive but can not withstand a direct hit from the truth, it’s then just a matter of loading up with the truth, taking aim and firing. A difficulty is actually hitting the target when the target itself controls the guidance system – which is the Press. Furthermore even when you’re on track to hit the target, the adjudicators at the targets behest can often move the target or simply claim that you missed. The other method the banks use to escape the truth is to bury it by insisting that all matters relating to their wrongdoing be kept confidential and separate.

(Some) RECOMMENDATIONS

Our suggestions in this respect are not intended to be exhaustive or even comprehensive but are merely intended to highlight principles in urgent need of addressing.

– Regulate to make decision making individuals within the banks personally accountable for their consequences of their decisions and actions (like other professionals – eg medical doctors and accounting auditors)

Whilst individuals remain unaccountable for their decisions and actions the world will be subjected to the consequences of these decisions and actions. It is therefore imperative that individuals that have the power to make decisions that affect others but are not accountable for the consequences of those decisions be stripped of their immunity.

Certain occupations such as medical doctors and accounting auditors are unable to hide behind a corporate veil when it comes to being accountable. The reason for this is to make sure they are careful to not make mistakes and if they do they will be held accountable.

Accordingly, bankers who are in a position to make determinations and decision that affect other people’s lives SHOULD NOT BE ALLOWED to hide behind the corporate veil and should have their decisions directly linked to them legally.

– Disallow unconscionable contractual wording through the establishment of an independent body through which banking contracts should first be approved. Sufficient evidence exists to support this move.

– Governments should not hire bankers to police bankers (see annexure 8 for more detail). It is very clear that Mr Greg Medcraft of ASIC was deeply involved with the manufacture and distribution of the various sub-prime assets that led to the GFC. The reason Mr Medcraft should not be the head of ASIC requires no further explanation and if it does then we’re all up the creek without a paddle.

– Symmetry in resources. The bank is well known for its practice for throwing sufficient dollars at the legal system to get its way. The very nature of the banking industry as a credit provider means by definition that – ‘most disputes will involve the withholding or withdrawal of credit by the banks’. Obviously any victim of the banks will be devoid of the resources to fight them with the only consequence that justice MUST be denied.

We recommend that in any dispute involving banks that the resources at the disposal of each side for litigation purposes should be symmetrical and equal. ONLY in this way will justice ever be served.

Accordingly, either banks’ should be limited to spending an amount equal to what the other side can afford or alternatively a mechanism should be put in place that provides the other side with a resource equal to what the banks would spend. This equitable approach may be achieved by establishing a government funded tribunal specifically designed for banking disputes only. This tribunal would provide equal funding for the plaintiff as well as the defendant.

– We further recommend that the government re-enter the banking business and establish a government bank along the lines of the original Commonwealth Bank of Australia. Currently government has no direct stake in the single largest commercial influence in the lives of its citizens. The privatisation of government enterprises has failed at least in this respect.

– It is strongly recommended this committee re-investigate the evidence and the conclusions drawn by the Parliamentary Joint Committee Inquiry into Financial Services and Products conducted in late 2009. Evidence of various CBA lies made to the PJC can be seen inannexure 9a, annexure 9b, annexure 9c, annexure 9d, annexure 9e and annexure 9f.

The Editor

The Plain Truth,

PO Box 2783

New Farm QLD 4005

Content : CGI terms & conditions, post-GFC banking sector, Commonwealth Bank news, Bernie Ripoll report, Senate Economics Committee.

On the 25th Feb 2009 while being seriously questioned by Senator Williams at a Senate Estimates Committee hearing, the not so bright Mr Jeremy Cooper, chose to cover his previous deeds by emphatically and deliberately lying. Mr Cooper’s “Not by us, no” response was just like a little boy caught out by his mother that responds with a straight face, “Who me? No”.

On the 25th Feb 2009 while being seriously questioned by Senator Williams at a Senate Estimates Committee hearing, the not so bright Mr Jeremy Cooper, chose to cover his previous deeds by emphatically and deliberately lying. Mr Cooper’s “Not by us, no” response was just like a little boy caught out by his mother that responds with a straight face, “Who me? No”. nered and not wanting to lie…on this occasion, chose to deliberately be obtuse and disrespectful by avoiding answering the question entirely and played the “maybe I am dumb, but what does gagged mean” card.

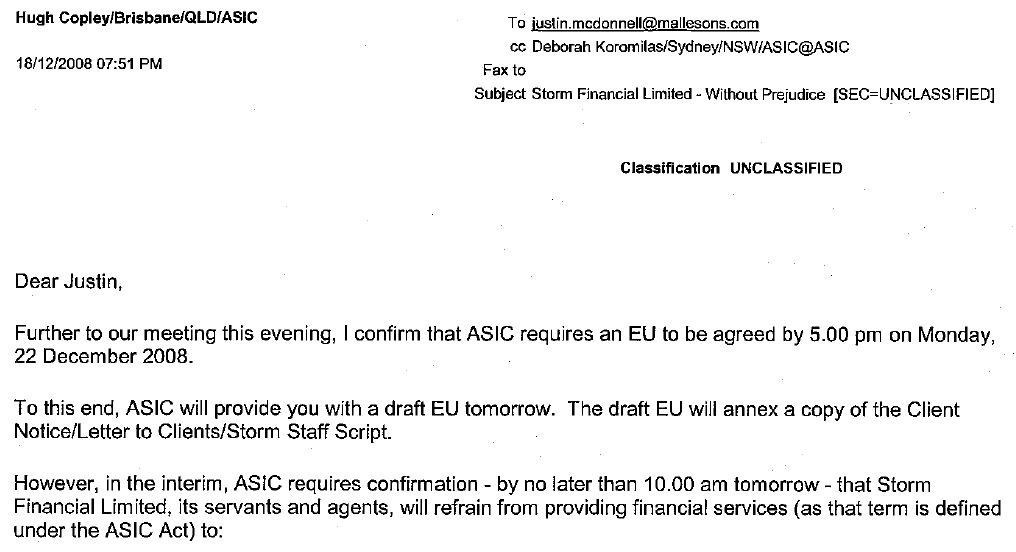

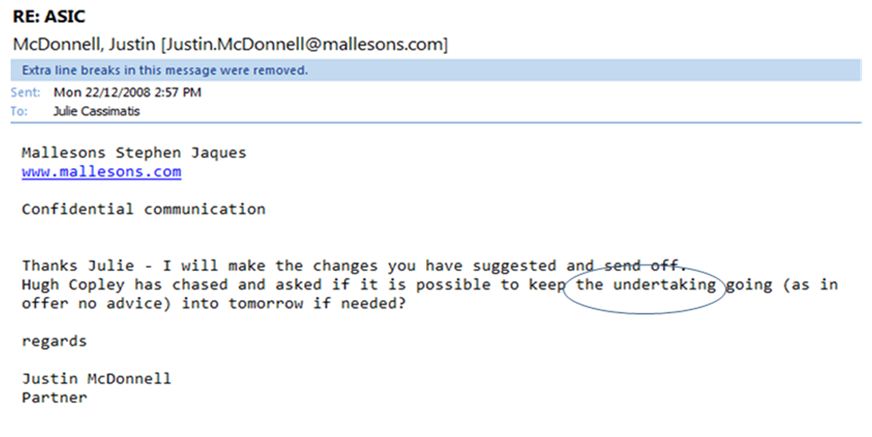

nered and not wanting to lie…on this occasion, chose to deliberately be obtuse and disrespectful by avoiding answering the question entirely and played the “maybe I am dumb, but what does gagged mean” card. A further email dated Monday 22nd Dec 08 again confirms that ASIC had not only demanded the gagging of Storm but also insisted on an extension of that gag.

A further email dated Monday 22nd Dec 08 again confirms that ASIC had not only demanded the gagging of Storm but also insisted on an extension of that gag. It is very clear in emails that ASIC precipitated the gagging of Storm and its advisors in late 2008. The disastrous effect of this gag was on the one hand to allow a free run for the CBA to illegally close down hundreds of client portfolio accounts resulting in billions of dollars of losses, whilst on the other hand Storm clients were prevented from contacting Storm staff or Storm advisors.

It is very clear in emails that ASIC precipitated the gagging of Storm and its advisors in late 2008. The disastrous effect of this gag was on the one hand to allow a free run for the CBA to illegally close down hundreds of client portfolio accounts resulting in billions of dollars of losses, whilst on the other hand Storm clients were prevented from contacting Storm staff or Storm advisors.